The Audit Log Q1'25 – The Future of Compliance is Intelligence

The Audit Log is Parcha's quarterly newsletter sharing our latest product and company updates. In this edition, we cover our new customer due diligence product for KYC reviews, how we're leveling up document verification with visual AI, our latest improvements to AML screening, and our vision for bringing more intelligence to compliance risk management.

Please don't forget to subscribe below if you haven't already!

Product Updates

Instant Customer Due Diligence on any individual

In conversations with our consumer-focused customers, we kept hearing about a common challenge: the time-consuming process of researching individuals during transaction monitoring alerts. Compliance analysts would spend up to an hour per case manually piecing together information about a customer's source of wealth and income to determine if their transaction patterns made sense.

We're excited to announce Instant Customer Due Diligence, which brings the same AI-powered automation we developed for business research to individual customer reviews.

Instant Customer Due Diligence uses AI to examine multiple data points from public sources to build a comprehensive profile of an individual in minutes:

- Employment history and income sources

- Real estate ownership records

- Business affiliations and ventures

- Digital footprint and lifestyle indicators

- Enhanced due diligence document verification

One early implementation highlight comes from an enterprise customer who was struggling with high-volume transaction alert reviews. By automating the research process that previously took analysts up to an hour per case, their team can now validate source of funds and assess customer risk profiles in minutes.

The feature is even more powerful when combined with document verification for enhanced due diligence. For example, if a customer provides proof of funds from a recent business sale, Parcha can automatically verify the document while gathering corroborating evidence from public sources about the transaction.

Leveling Up Document Verification with Visual AI

Since launching real-time document verification last quarter, we've been focused on one question: how do we catch sophisticated document fraud without creating more work for compliance teams? The answer came from studying how expert analysts spot suspicious documents - they don't just read the text, they look for subtle visual inconsistencies that often indicate tampering.

This quarter, we're excited to announce three major enhancements to our document verification:

Visual Intelligence: Our multi-modal AI now examines documents the way human experts do - catching subtle irregularities in seals, signatures, and formatting that traditional OCR systems miss. For example, when analyzing a Delaware incorporation document, the AI understands where official seals should be positioned and can detect even minor irregularities in their appearance.

Digital Forensics: Through our partnership with Resistant AI, we've added sophisticated metadata analysis that can detect tampering attempts. The system examines everything from creation timestamps to digital signatures, uncovering the subtle traces that fraudsters leave behind when editing documents.

Microscopic Analysis: For those telltale signs of tampering - like inconsistent font kerning or unusual pixelation - we've built an intelligent analysis system that examines documents at the pixel level. Multiple AI models analyze different aspects simultaneously, from font consistency to color patterns.

These capabilities build upon our real-time document verification to create a system that's both faster and more secure than traditional approaches - no more choosing between speed and safety.

You can learn more here: Tech Deep Dive: A Smarter Approach to Document Verification

Enhanced AML Screening: Beyond Simple Name Matching

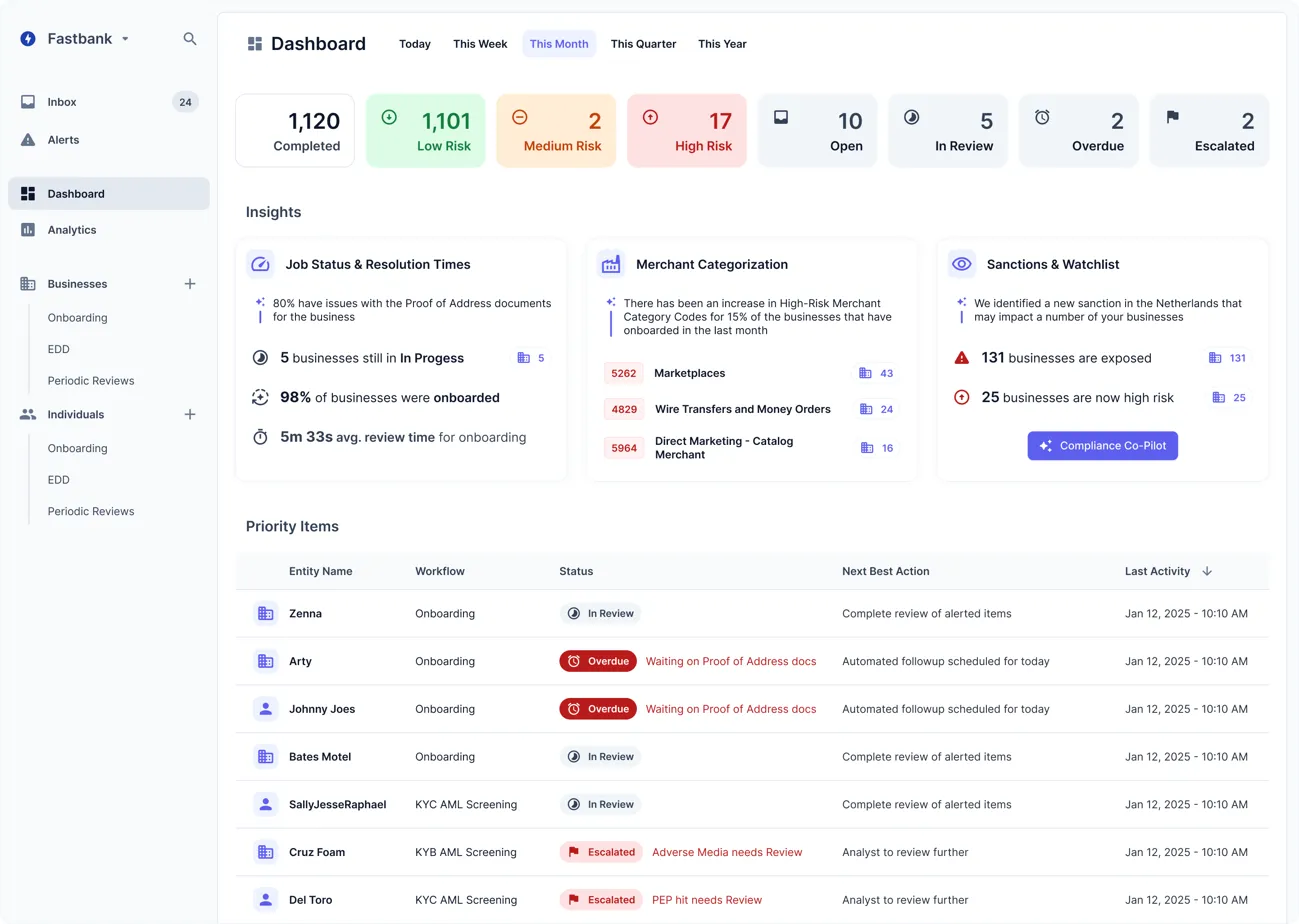

False positives in AML screening continue to be one of the biggest operational challenges for compliance teams. While existing screening providers ensure you never miss a high-risk customer, they often generate thousands of false positives that require manual review. We're excited to announce several major enhancements to our intelligent screening capabilities this quarter.

First, we're thrilled to announce our partnership with ComplyAdvantage as our preferred AML screening provider. This partnership combines ComplyAdvantage's comprehensive global coverage with Parcha's AI-powered alert review system, creating an end-to-end solution that dramatically reduces false positives while maintaining the highest AML compliance standards.

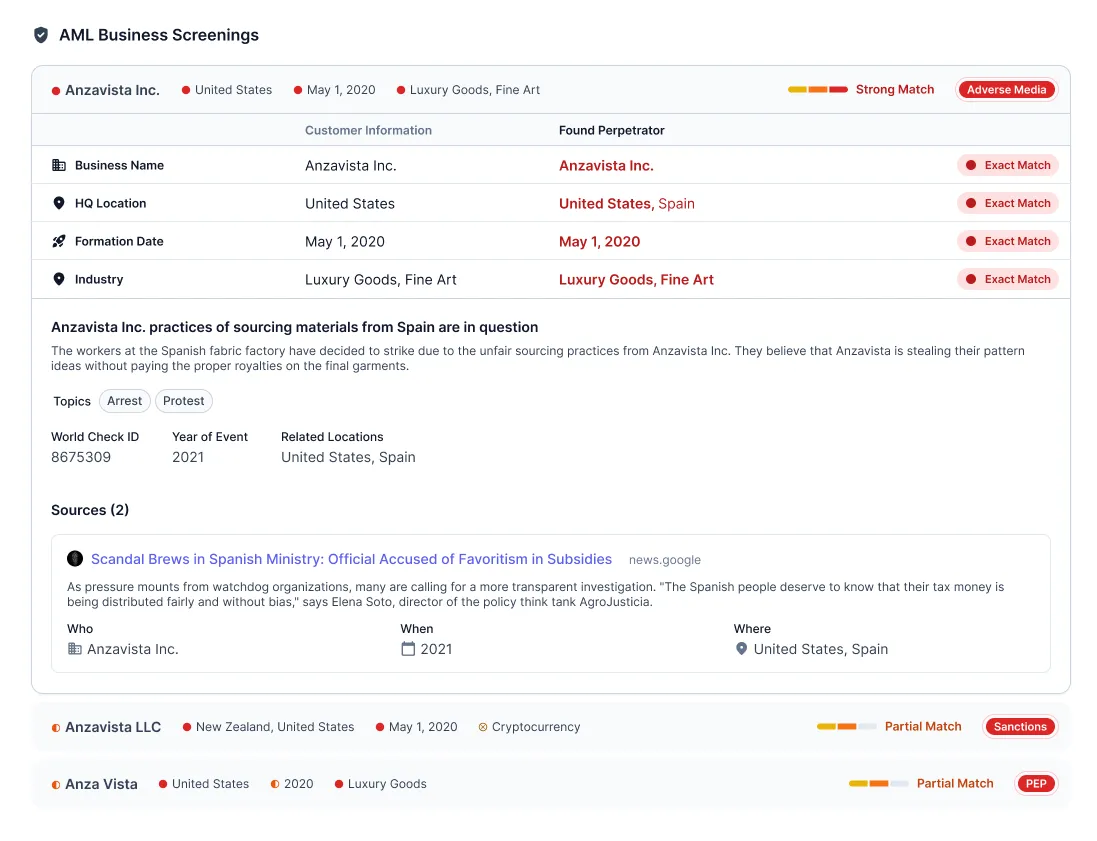

We've also completely redesigned our screening interface to provide a consistent experience across both business and individual profiles. The new unified view makes it immediately clear which hits are relevant and why, with our AI providing clear explanations for each match. As shown in the examples above, compliance analysts can now quickly understand the relationship between a customer's profile and potential matches, with exact and partial matches clearly highlighted.

What sets our approach apart is how we determine whether a screening hit is actually relevant to your customer. Rather than relying on simple name matching, our hybrid system looks at multiple data points simultaneously:

- Identity matching across name, age, location, and other attributes

- Temporal analysis to verify dates align with reported events

- Relationship analysis to determine the customer's actual role in any adverse events

- Risk assessment based on the specific nature of the hit

For example, when reviewing adverse media hits, our AI doesn't just match names – it understands the context of the article to determine if your customer was actually the perpetrator of the reported incident or simply mentioned in passing. This sophisticated reasoning is particularly powerful when combined with our new unified profile view for both businesses and individuals.

This intelligence layer transforms AML screening from a volume challenge into a precise risk assessment tool, allowing compliance teams to focus their expertise where it matters most.

Learn more about our unique approach to AML screening here: How Parcha Reduces Global AML False Positives by 90% Using Context-Driven LLM Workflows

What's next

A System of Intelligence for Compliance

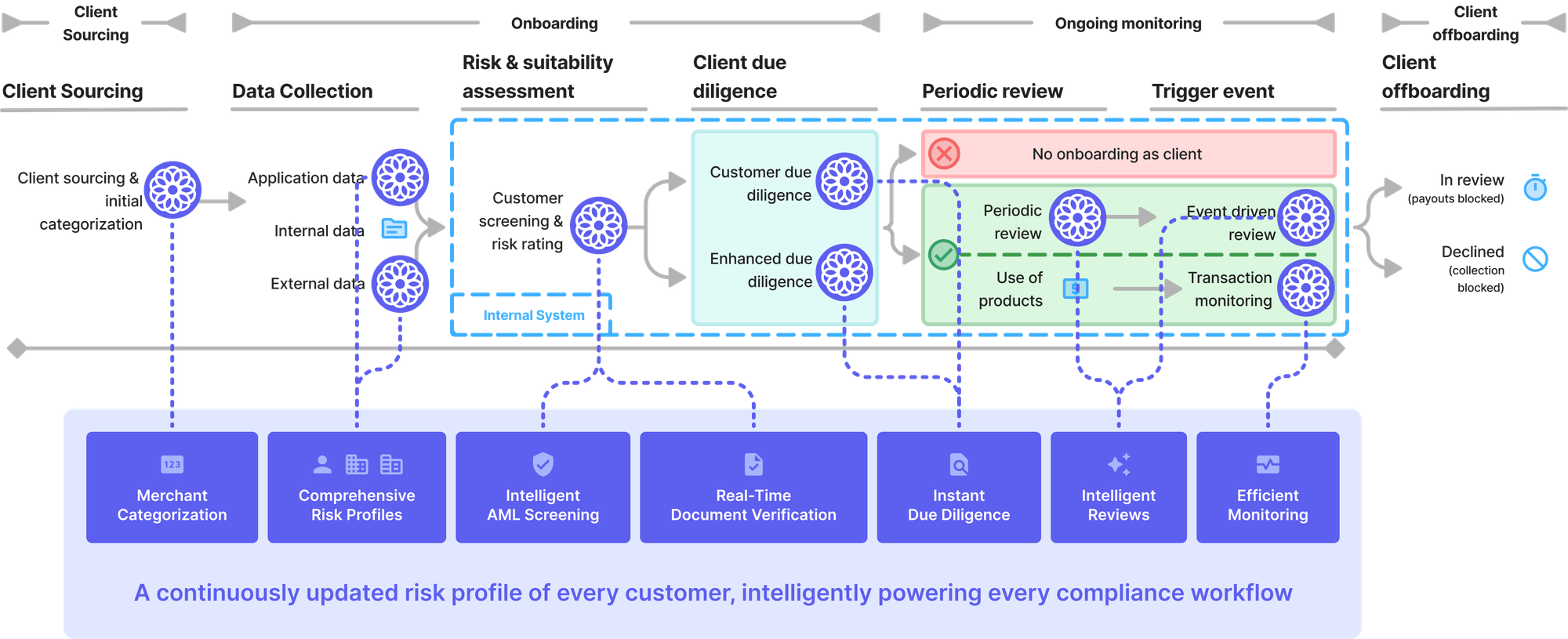

When we launched Parcha, we set out to solve a clear problem: the inefficiency of manual compliance workflows. But as we've worked with customers like Bridge, Flutterwave, and FV Bank, we've uncovered a deeper challenge that's costing the financial industry over $200B annually. Today's compliance systems are fundamentally fragmented – separate solutions for KYC, transaction monitoring, and sanctions screening, each generating their own alerts, maintaining isolated customer data, and operating without context of the broader risk picture.

The result? Over 90% of alerts are false positives, compliance teams are overwhelmed, and growth is bottlenecked. While our initial focus on accelerating workflows has helped unlock significant efficiency gains, we're now building toward a more ambitious vision: The System of Intelligence for Compliance.

At the heart of this system are three innovations:

- AI-Powered Compliance Agents: Imagine an AI that doesn't just flag issues – it resolves them. Our compliance agents can engage directly with customers to gather missing information, clarify discrepancies, and remediate alerts, all while maintaining a natural, contextual conversation. When a customer's proof of address raises concerns, instead of creating a manual review task, the agent immediately reaches out to request clarification or alternative documentation.

- Continous Compliance Risk Monitoring: Every interaction, document, and risk signal related the an entity feeds into a comprehensive and continously updated risk intelligence profile that grows smarter over time. When reviewing a sanctions alert, the system doesn't just check name matches – it understands the full context of the customer's history, transaction patterns, and business relationships. This shared intelligence makes every workflow more efficient, from onboarding to ongoing monitoring.

- Global AML Intelligence: Beyond individual customer reviews, our system provides unprecedented visibility into AML risk across your entire customer portfolio, globally. From the moment a customer onboards through every transaction and interaction thereafter, you'll have real-time insights into risk trends, emerging patterns, and potential concerns. This holistic view enables proactive risk management, more informed growth decisions and highly efficient risk operations.

What does this mean in practice? Consider a typical compliance alert. Instead of an analyst having to manually research the customer, review documents, and send follow-up emails, our System of Intelligence:

- Automatically cross-references all available data points

- Uses AI to determine if human review is actually needed

- Engages directly with the customer to resolve simple issues

- Provides analysts with complete context when escalation is necessary

- Surfaces portfolio-wide insights to inform risk strategy

The goal is simple but powerful: unlock more growth for our customers without compromising on risk using AI. We're excited to begin making this system available to a select group of fast-growing fintechs in 2025. If you're interested in being among the first to experience this next evolution of compliance technology, reach out to founders@parcha.ai to learn more.

🎙️Featured Podcast

What Trump's Second Term Means for Fintech, Banking and Crypto Compliance

Compliance Accelerated is our AI-generated podcast exploring the future of compliance and risk management in banking and fintech. The first eight episodes of season are now available on Apple Podcasts and Spotify.

In episode 7 of Compliance Accelerated, our AI hosts explored the potential transformation of the fintech and cryptocurrency landscape under Trump's second term, including:

- Expected shifts in crypto regulation, including potential SEC leadership changes

- The impact of deregulation on fintech innovation and startups

- Changes to sanctions strategy and enforcement

- How compliance teams can prepare for the evolving regulatory landscape

It's a great episode to listen to if you want to make sense of the quickly evolving compliance landscape under the new administration.

You can listen to the full episode here:

Here's a few more of our favorite episodes from last season:

🎧 Listen to all of Compliance Accelerated season 1:

📣 Company Updates

Welcome Xia: Our Newest Engineer

We’re excited to welcome Xia to Parcha! In his first week, Xia built an end-to-end demo that turned into a six-figure contract. We’re thrilled to have him on board.

We're Hiring in San Francisco!

As we build the System of Intelligence for Compliance, we're looking for exceptional talent to join our founding team:

If you're excited about transforming compliance with AI, we'd love to hear from you. Reach out to careers@parcha.ai to learn more.

Want more updates from Parcha?

Keep up with everything we’re doing at Parcha by subscribing below!

Or... chat with our CEO and get a live demo of Parcha here:

And don't forget to follow us on LinkedIn

About Parcha

Parcha enables banks and fintechs to onboard more customers faster, with stronger compliance using AI to accelerate KYC/B reviews, document verification and AML screening.

Learn more here 👉 https://parcha.com

You received this email because you expressed an interest in Parcha. If you don’t want to receive more emails from us, feel free to unsubscribe below!