The Audit Log Q2 2025 – Create AI agents in minutes, Alloy integration, and 47+ updates

In this edition, we share a preview of Agent Hub, our new AI agent platform for compliance and risk teams to create AI agents in minutes.

The Audit Log is Parcha's quarterly newsletter sharing our latest product and company updates. In this edition, we share a preview of Agent Hub, our new AI agent platform for compliance and risk teams. We also share more about our new Alloy integration and cover the latest product updates from Q2.

Please don't forget to subscribe below if you haven't already!

Quarterly Product Updates

Let's kick off with some exciting product updates! It's been a busy quarter here at Parcha. Here's what's new...

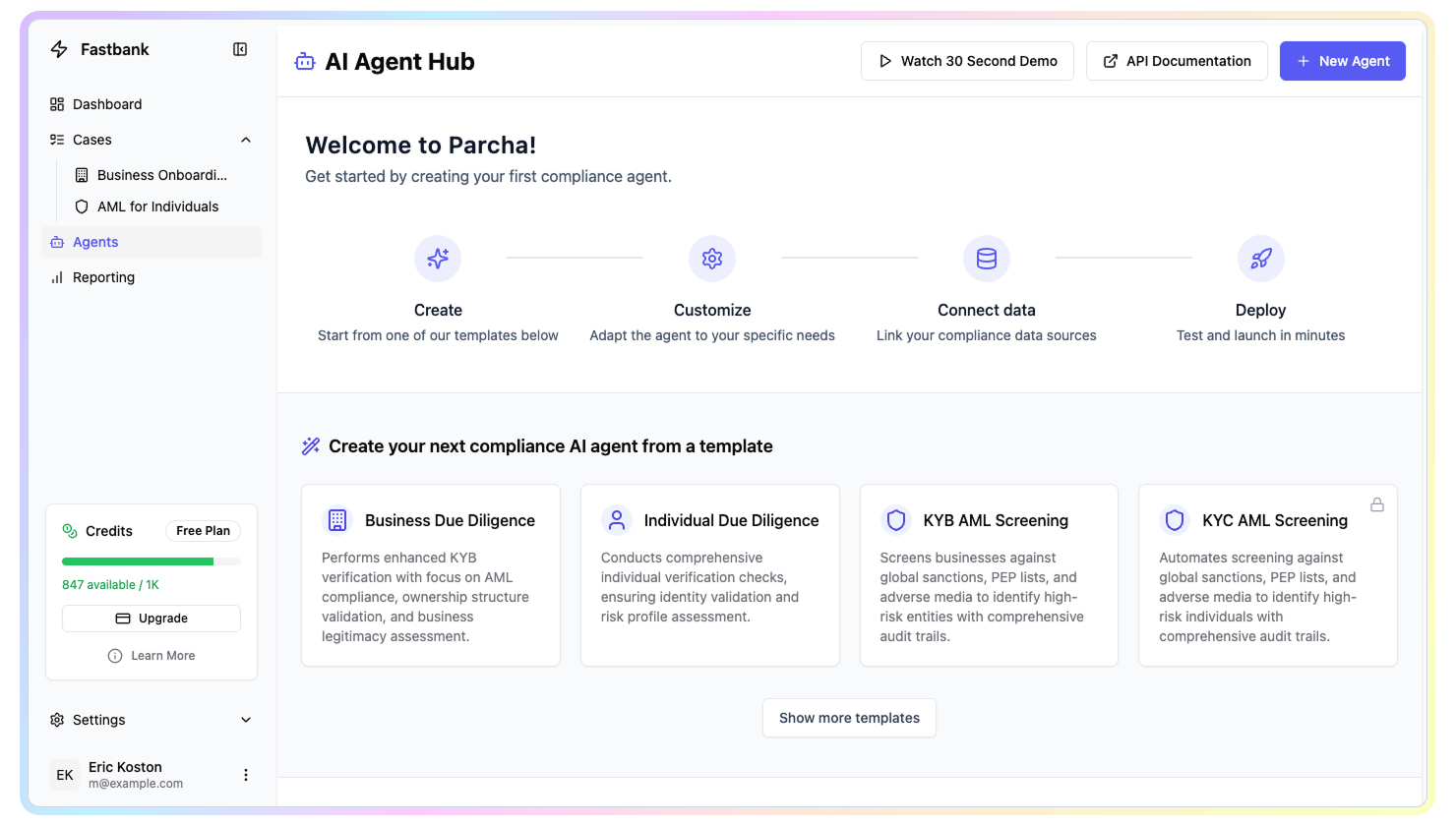

🤖 Create AI Agents in minutes with Agent Hub

At Parcha, we've partnered with the world's leading fintechs to solve one of their toughest problems: fast, efficient, and cost-effective compliance. Customers such as Airwallex, Pipe, Flutterwave, and FVBank utilize Parcha's AI agents to automate enhanced due diligence, AML screening, and document verification.

One of the challenges fintechs and banks encounter with existing AI solutions is that it can often take weeks or months to set up, customize, integrate, and fully realize their value. This is especially true when solving the complex workflows required for compliance, making AI agents less accessible to compliance teams with limited resources to invest in months-long integrations. Over the last few months, we've been on a mission to change this and accelerate time to value for our customers from months to minutes with Agent Hub.

Agent Hub is a new platform that enables compliance teams to create, customize, and deploy AI agents in minutes, not days or weeks.

With Agent Hub, compliance teams can:

- Choose from over a dozen preconfigured AI Agents for customer onboarding, enhanced due diligence, AML screening, merchant categorization, vendor due diligence and much more.

- Quickly customize the AI agent to match existing processes and risk frameworks.

- Start testing an AI agent in minutes with sample datasets or by simply uploading a CSV file.

Here's a live demo of Agent Hub in action from Finovate Spring:

Agent Hub is now available for early access to all our existing and prospective customers. If you would like to supercharge your compliance team with AI agents, schedule a 15-minute tour and get onboarded by our team.

We will be officially launching Agent Hub soon!

🤝 Use Parcha in Alloy

Every compliance team knows the pain. You've invested in automated onboarding workflows — seamlessly orchestrating KYC checks, AML screening, and fraud, but then reality hits. When those complex cases get flagged for manual review, your team still gets buried in backlogs, spending hours manually reviewing business due diligence documents and parsing through AML alerts that should take minutes, not days.

That's exactly why we've brought Parcha's AI to Alloy.

Parcha has partnered with Alloy to bring AI agents to hundreds of fintechs and banks using their platform. Now, when your existing Alloy workflow flags a business for enhanced due diligence or triggers an AML screening alert on an individual, you can instantly hand that case off to Parcha's AI agents.

Here's what changes: Your business due diligence that used to take analysts 45 minutes per case now gets completed by our AI agents in under 3 minutes. Those AML alerts that created end-of-quarter scrambles? Our agents process them in real-time, with the same thoroughness as your most experienced compliance officer.

Ready to see your compliance backlog disappear?

Schedule a 15-minute demo with Parcha or reach out to your Alloy representative to learn more.

🚀 47+ improvements to Parcha

While Agent Hub was the main event this quarter, our engineering team shipped over 47 updates that directly impact how fast and accurately you can process cases in Parcha, including:

- ComplyAdvantage automation — Automatically trigger Parcha AI agents directly from AML screening alerts in ComplyAdvantage Mesh to automatically review and resolve false positives.

- Expanded data coverage — Added OPoint, Yelp, TripAdvisor, TrustPilot, Better Business Bureau, and Google Places integrations.

- Lightning-fast document processing — Validation in under 20 seconds, plus visual verification for incorporation docs across all 50 US states.

- Surgical location matching — City and state-level precision for AML screening instead of broad country matching.

- Flexible web research — Choose between fast or deep research modes depending on your speed and cost requirements.

- Advanced OSINT for PEPs — Automatically enrich PEP matches with social media, employment history, and address verification, allowing more accurate discounting of false-positives.

- Smarter name matching — Name Matching V3 system handles cultural conventions, compound surnames, and titles better.

- Custom document verification — Pick specific document elements to verify against self-attested data.

- New cases overview table — Run multiple cases simultaneously with summarized outputs and detailed check results at a glance. Available to Agent Hub users.

If you want a tour of the latest Parcha features, schedule a demo with us below!

Company Updates

🎤 Parcha demo at Finovate Spring

Last month, we had the chance to demo Parcha on the main stage at FinovateSpring, showing how AI can help compliance teams move faster, reduce onboarding time, and focus on the bigger picture: mitigating risk, not chasing paperwork.

Thanks to all those who stopped by at our booth to talk about their compliance challenges and to learn how Parcha's customers are delivering 2–3x efficiency gains while maintaining 99%+ accuracy.

One of the highlights of our San Diego trip was the dinner we hosted with a group of fintech and compliance executives and thought leaders from J.P. Morgan, Wells Fargo, LendingClub, Academy Bank, WSECU, First Bank of the Lake, Piper Sandler, American Bankers Association, and Alloy-Labs.

Thanks to everyone who joined us last week, and to Finovate for the opportunity to share what we’re building—and to keep learning from the people doing the work.

P.S. We’re planning more of these dinners—curated rooms, honest discussions, and voices from across fintech, compliance, and risk. If that sounds like something you'd want to be part of, please reach out to anu@parcha.ai.

👋🏽 Welcome Anu – Head of Revenue

Anu joins us from Yotascale, where she led sales and has been in San Francisco for over 25 years! In Anu's first two weeks at Parcha, she helped us land a pilot with a publicly traded global fintech company and effortlessly worked our booth at Finovate, not to mention organizing a great dinner too!

🌁 We're Hiring in San Francisco!

As we build the System of Intelligence for Compliance, we're looking for exceptional talent to join our founding team:

If you're excited about transforming compliance with AI, we'd love to hear from you. Reach out to careers@parcha.ai to learn more.

Want more updates from Parcha?

Keep up with everything we’re doing at Parcha by subscribing below!

Or... chat with our CEO and get a live demo of Parcha here:

And don't forget to follow us on LinkedIn

About Parcha

Parcha supercharges compliance teams with AI agents to complete KYC/KYB reviews more accurately and efficiently.

Learn more here 👉 https://parcha.ai

You received this email because you expressed an interest in Parcha. If you don’t want to receive more emails from us, feel free to unsubscribe below!