Product Update: Document Verification and UBO checks now in Agent Hub, +20 more improvements

A month ago, we launched the Agent Hub and promised you that this was just the beginning. Today, I'm excited to share what we've shipped since then: Over 20 features and bug fixes, including document verification, KYC for UBOs as part of a KYB process and an improved case management table. With every update, our AI agents can solve more complex compliance workflows without sacrificing accuracy or speed.

Agent Hub Updates

We're excited to share three major updates we've made to Agent Hub over the last month.

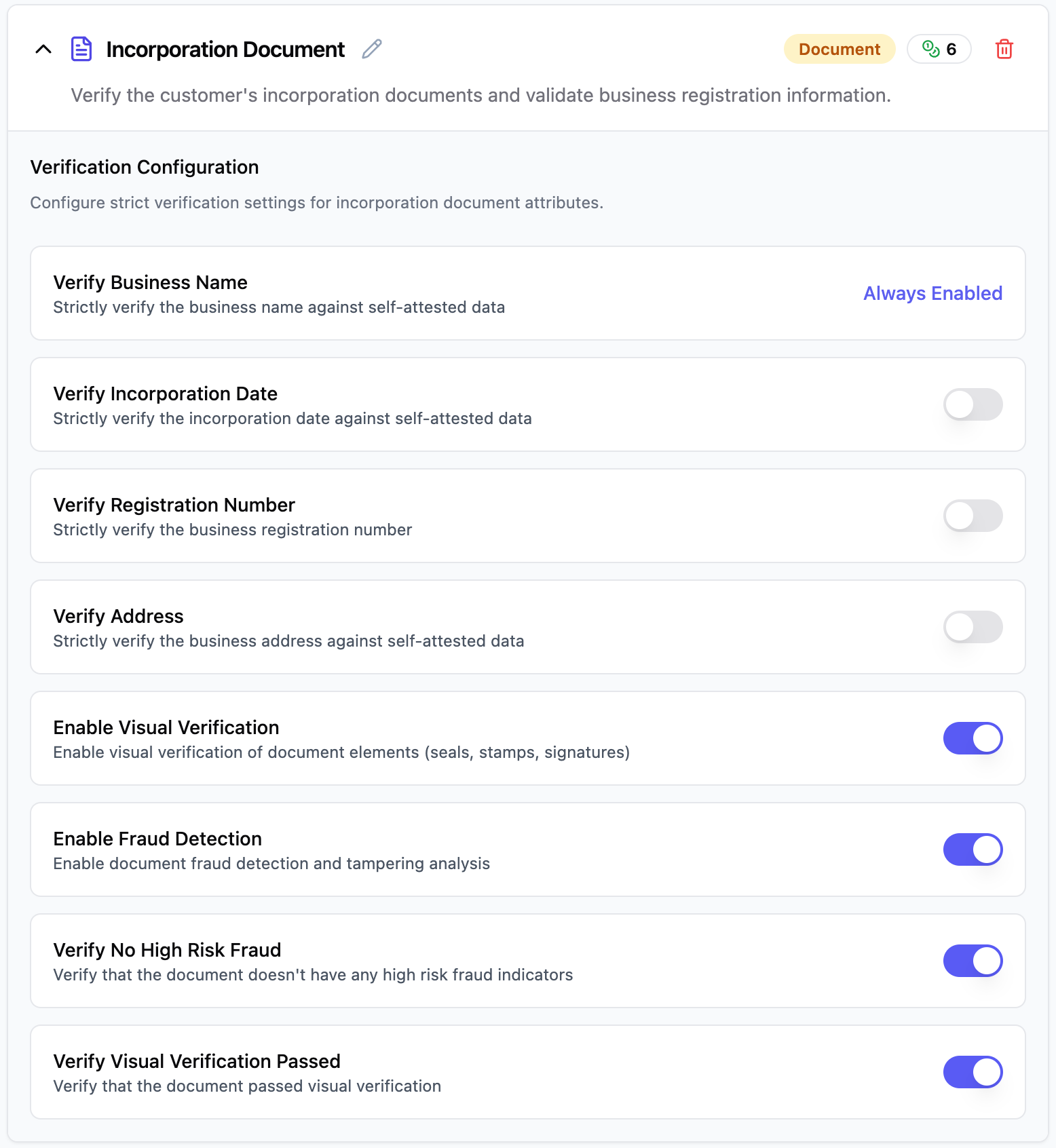

1. Customizable Document Verification

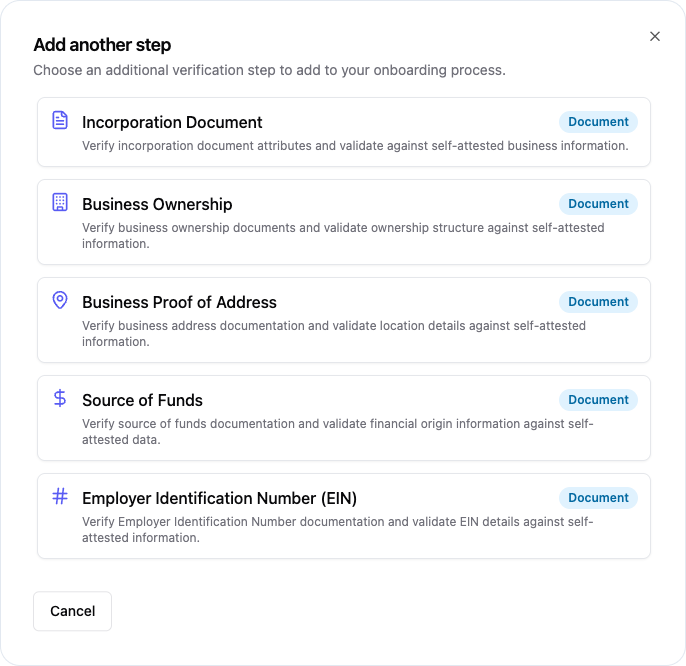

Our enterprise business document verification capabilities are now available to any compliance team in the Agent Hub. You can customize verifications for incorporation, business ownership, proof of address, EIN and source of funds documents. Pick and choose exactly which documents to include in your KYB verification workflow and customize each one to your needs.

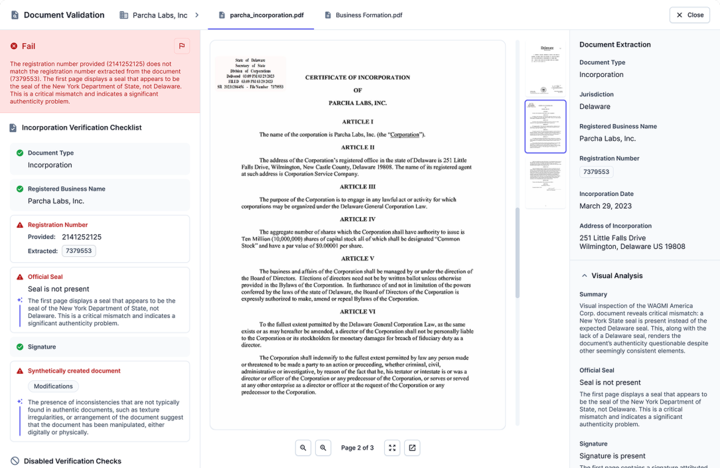

Incorporation Document Verification:

- Support for incorporation documents from any jurisdiction globally

- Visual verification for all 50 US states, France, Hong Kong, and 11 Eastern European countries (LT, BG, HR, CZ, EE, HU, LV, PL, RO, SK, SI)

- Automated extraction of key business details like registration numbers, dates, and entity status

Additional Document Verification Options:

- EIN verification with automated tax ID verification for US businesses.

- Business proof of address with enhanced location verification to determine if the address isn’t a P.O. Box, registered agent or law firm.

- Source of funds verification for advanced financial document analysis to determine if source of funds meets a specific threshold

- Business ownership document verification that can verify which business owners meet a specific ownership percentage.

What makes Parcha’s document verification unique

Parcha’s document verification process uses a combination of OCR, multimodal AI and ML models to verify documents are the correct format, make sure the extracted data matches the associated business and that the document has not been tampered with. Each document verification in Agent Hub is configurable to select exactly what to extract and verify to meet your specific requirements. And with the upgraded document viewer, you get a complete view of the document, the AI's reasoning, and exactly what passed or failed.

How to get started with document verifications

Need incorporation documents but not EIN verification? Want to check source of funds verification but not proof of address?

You can start verifying documents in Agent Hub by selecting an agent template that includes documents or adding a document verification step when customizing your agent.

Learn more about how Parcha’s document verification system works here.

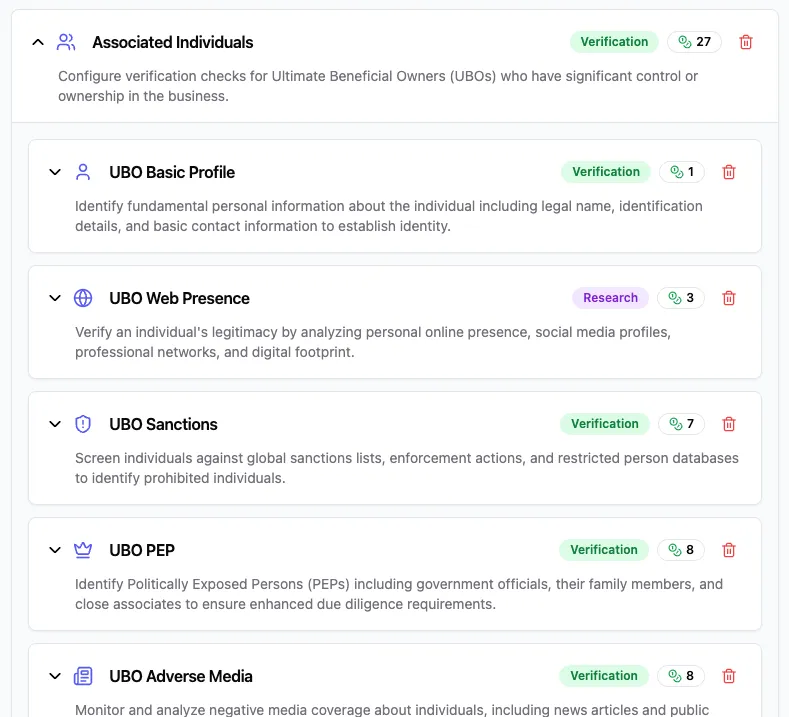

2. Check UBOs as Part of Your KYB Process

One of our most widely requested features, automatic KYC screening for Ultimate Beneficial Owners during business verification, is now available in Agent Hub.

When you run KYB verification, you can automatically trigger individual KYC screening for all the UBOs included in the agent's inputs. This means full AML screening, sanctions checks, and web presence analysis for every UBO.

This isn't just convenient, it's how compliance actually works in the real world. You don't verify businesses and individuals separately. You verify businesses, then you verify the people who own them together. Now you can do that in Agent Hub.

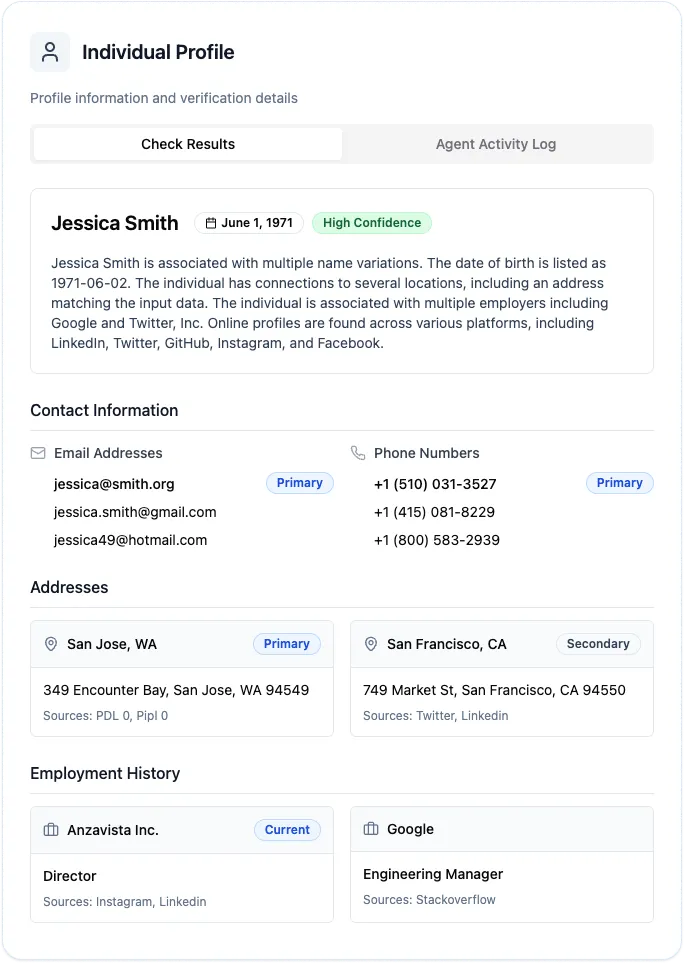

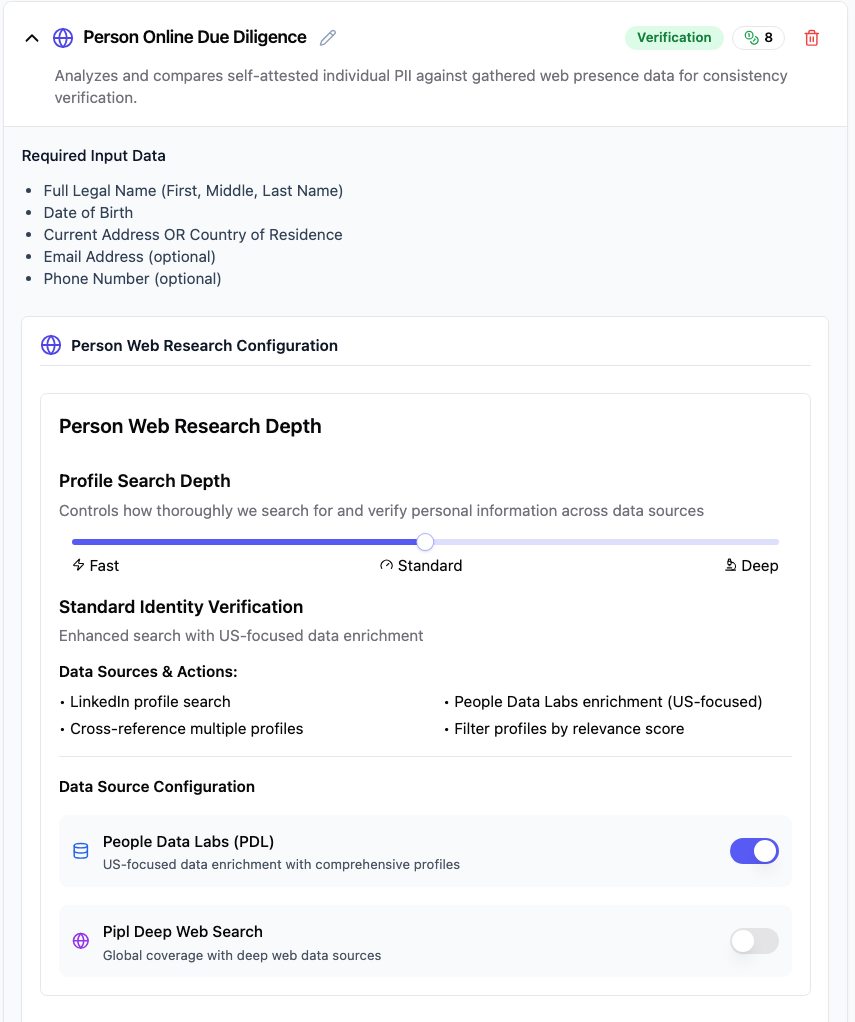

3. Agentic Deep Research for Individuals

We've supercharged individual research with tools that actually think like a human investigator. The Individual Web Presence Research Tool doesn't just search for someone's LinkedIn profile and call it done. It builds a comprehensive picture:

- Cross-references multiple data sources (PDL, Pipl, and web research)

- Analyzes career history and validates employment claims

- Assesses location consistency across different profiles

- Generates match strength scores based on comprehensive identity verification

The deep research agent, when combined with AML screening, dramatically reduces false positives—for example, identifying a PEP profile that doesn't match your customer by comparing the PEP's role with your customer's employment history, or verifying that adverse media for someone with the same name and age is not related to your customer by comparing address history.

To get started, just add the Person Online Due Diligence check to any KYC agent and select Deep for the analysis depth in the configuration:

The Little Things That Make a Big Difference

Sometimes the most important improvements are the ones that save you 30 seconds, 50 times a day:

Bulk Deleting Cases: Delete multiple failed cases at once instead of clicking through them one by one.

Full-Width Case Tables: We expanded the cases overview to use the full screen width. More data visible, less scrolling.

Improved CSV Import: We now automatically map your CSV columns to our input fields using AI, so you no longer have to convert your data to our template format.

We've also squashed 20+ bugs that were slowing you down including:

- Fixed cases disappearing after submission in AML screening

- Resolved PDF preview loading indefinitely in document flyouts

- Standardized step naming across all templates

- Eliminated duplicate steps appearing in template configurations

- Made age threshold slider consistent across all KYC AML screening steps

- More configuration options for AML screening

The theme across all these fixes? Making sure you can get faster more accurate responses from Parcha's AI agents with the least amount of effort!

What This Update Means for Your Business

Let's be practical here. These aren't just feature updates - they're solutions to real problems you face every day:

For Compliance Teams: You can finally configure verification workflows that match your actual requirements instead of working around our limitations.

For Financial Services: The UBO screening integration means you can onboard businesses faster while maintaining complete AML compliance.

For Fintech and Payments: Global document support means you can expand to new markets without rebuilding your verification stack.

For Risk Teams: The enhanced individual research gives you the deep intelligence you need to make confident decisions about high-risk customers.

Looking Forward

We launched Agent Hub to allow compliance teams to create, customize and deploy AI agents in minutes and to supercharge their productivity and that’s exactly what we’re seeing. You're building custom agents for your specific compliance needs, and we're providing the intelligence tools to make those agents incredibly effective.

Parcha 2.1 is available now. If you're already using the Agent Hub, these features will appear automatically. If you're not yet using Parcha, now might be the perfect time to see what AI-powered compliance can do for your business. You can get started for free with 1,000 Agent Hub credits on us!

With all the capabilities of our enterprise product now available to any compliance teams with Agent Hub, we’re now focused on upgrading our core agent infrastructure to support even more complex workflows. We will have more updates on this soon!

Join Parcha @ Agents In The Enterprise

Hear what we've learnt from deploying AI agents at the world's leading fintechs from our CEO AJ Asver at Agents In The Enterprise next week in San Francisco.

On Wednesday, September 3rd at 3:00pm, Kindred Ventures, in partnership with Unified Agentforce Platform at Salesforce and Microsoft for Startups, will host a timely event on the rise of intelligent systems.

As builders push to create agents that can reason, automate, and collaborate, this event will gather the voices driving the field forward. You’ll hear from AJ Asver, Co-Founder & CEO of Parcha and Haya Sridharan, Co-Founder & CEO of Chicory, about building AI agents for compliance and data engineering, as well as Rob Ferguson (Head of AI, Microsoft for Startups) and Vivienne Wei (COO, Unified Agentforce Platform at Salesforce).

With the market rapidly taking shape for enterprise agents, we’ll explore lessons from the front lines: what’s working, what’s breaking, and what’s next. Conversations will dive into practical strategies, scaling challenges, and emerging use cases in enterprise automation and orchestration for GTM functions.

Want to see Parcha in action? Book a demo and we'll show you exactly how these new capabilities can streamline your compliance workflows.