Product Spotlight: Verify Ultimate Business Ownership in minutes

At Parcha, we're constantly innovating to solve the most pressing challenges faced by fintechs and banks in the onboarding process. Today, we're thrilled to share our latest spotlight: AI-Powered Business Ownership Verification. This cutting-edge solution is set to revolutionize how financial institutions handle the complex task of verifying business ownership structures and vetting business owners.

The Challenge

Business Ownership Verification and Compliance

Verifying the ownership structure of a business and minimizing risk is a persistent challenge for compliance teams. The manual and error-prone process involves analyzing documents, identifying Ultimate Beneficial Owners (UBOs), and conducting thorough background checks on owners. This task becomes more complex as business structures become more intricate.

The Corporate Transparency Act (CTA), implemented earlier this year, has added another layer of complexity for fintechs and banks when onboarding new customers compliantly.

CTA regulations now mandate American businesses to disclose Beneficial Ownership Information (BOI) to the Financial Crimes Enforcement Network (FinCEN). However, FinCEN's database of BOI data is not publicly accessible, and companies must update BOI information whenever there are changes in office locations or new investments. The lack of access to FinCEN registration data poses a challenge for fintechs and banks in ensuring the accuracy of customer information compared to FinCEN records.

Non-compliance with these regulations can lead to significant financial penalties, with fines up to $500,000 per violation. Fintechs and banks risk their licensing by onboarding customers whose business information conflicts with FinCEN records.

To reduce these risks, companies like Flutterwave previously spent 24 hours per analyst onboarding each new customer. Parcha's AI-powered Due Diligence solutions make this process much faster, so Flutterwave can onboard those same companies in minutes, with the same level of compliance.

The Solution

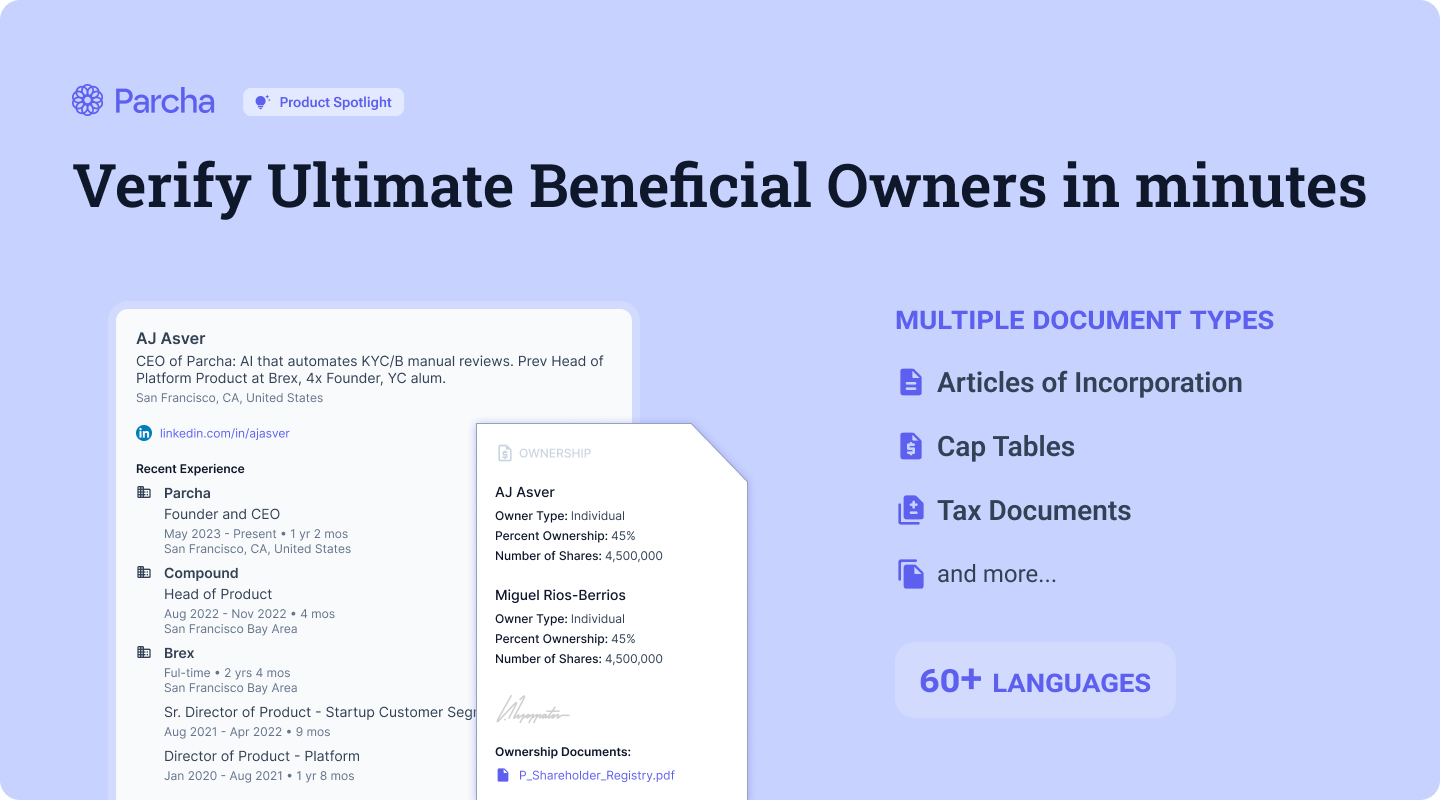

Verify Ultimate Business Owners in minutes

Last week, Parcha unveiled our comprehensive Compliance Reports that scan the entirety of a businesses’ online presence, synthesize mainstream and social media coverage, sanctions & watchlists and leadership profiles. This week, we’re showcasing how Parcha customers can overlay Compliance Reporting with our Ownership Documents Check to verify ownership.

Together, these features leverage advanced artificial intelligence to transform Due Diligence, so fintechs and banks can grow faster, with confidence. Here's how it works:

Business Ownership Verification:

- Intelligent Document Analysis: Our AI scans and analyzes a wide range of ownership documents, including Articles of Incorporation, Cap Tables, and Tax documentation.

- Fraud Detection: The system automatically checks for signs of fraud or tampering, ensuring the integrity of the submitted documents.

- Document Validation: Each document is verified to be a valid incorporation ownership document, eliminating the risk of processing incorrect or irrelevant paperwork.

- UBO Extraction: The AI accurately extracts information on Ultimate Beneficial Owners, including percentage ownership and number of shares.

- Cross-Verification: Extracted data is automatically cross-checked against self-attested information for discrepancies.

Key Benefits:

- Enhanced Accuracy: Eliminate human error in interpreting complex ownership structures and vetting owners.

- Time Efficiency: Reduce the time spent on manual document review, ownership verification, and owner background checks from days to minutes.

- Improved Compliance: Ensure consistent and thorough identification of UBOs and owner vetting, meeting regulatory requirements with confidence.

- Fraud Prevention: Catch potential fraud attempts early with automated document authenticity checks and comprehensive owner background analysis.

- Risk Mitigation: Identify potential risks associated with business owners before they impact your institution.

- Scalability: Handle increasing volumes of business onboarding without compromising on thoroughness or speed.

Customization and Integration

We understand that every financial institution has unique needs and compliance requirements. That's why we've made our Business Ownership Verification feature highly customizable:

- Tailor the types of ownership documents accepted

- Set specific thresholds for UBO reporting

- Customize alerts for high-risk ownership structures or owner backgrounds

- Define specific criteria for owner vetting based on your risk appetite and regulatory requirements

Our robust API allows for seamless integration into your existing onboarding workflows, ensuring a smooth transition and immediate impact on your operations.

Looking Ahead

Parcha is working hard to help fintechs and banks handle compliance challenges more easily. Keep an eye out for updates that will make Parcha's AI compliance solutions even simpler, faster, and smarter.

Ready to Take the DIY out of KYB?

Reach out to our team at founders@parcha.ai to see how our AI-Powered solution can work for your institution.