Product Spotlight: Sanctions & Watchlists

Target the Ballooning Problem of False Positives with AI-Powered Precision

Global events are changing rapidly, and top fintech companies are struggling to keep up with the growing instability in different regions. The conflict between Russia and Ukraine led to the introduction of 11,097 new sanctions in 2022. In 2023, every major jurisdiction grew its sanctions list by more than 10%. 2024 is already looking like it will bring double-digit growth in designations, resulting in more false alarms for compliance teams.

Parcha can’t stabilize global dynamics, but we can reduce the risk and resource strain they pose to fast growing fintechs and banks. Our team is dedicated to addressing this critical issue through our AI-powered Sanctions & Watchlist Screening. By eliminating false positives when screening new clients, Parcha's customers can manage risk while maintaining growth in a volatile world.

The Problem

Time-Consuming False Positives

False positive rates skew high across the AML workflow, but they are especially common when screening identities and businesses against global sanctions and watchlists. Outdated technology deserves some of the blame for this problem.

Legacy automation software isn’t capable of flagging the right entities and individuals. Rule-based algorithms rely on simple identity-matching techniques, neglecting common nicknames and abbreviations and ignoring regional linguistics. It cannot get smarter over time by training on its own output. Nor can it process unstructured data, such as government reports, legal filings, news articles and social media posts, to reinforce its identification confidence.

Legacy software isn’t the sole offender. Data silos, high operational costs, and inaccurate or outdated data sources all contribute to the epidemic of false positives. These false alarms not only waste valuable time and resources but also prevent legitimate businesses from onboarding smoothly.

The Solution

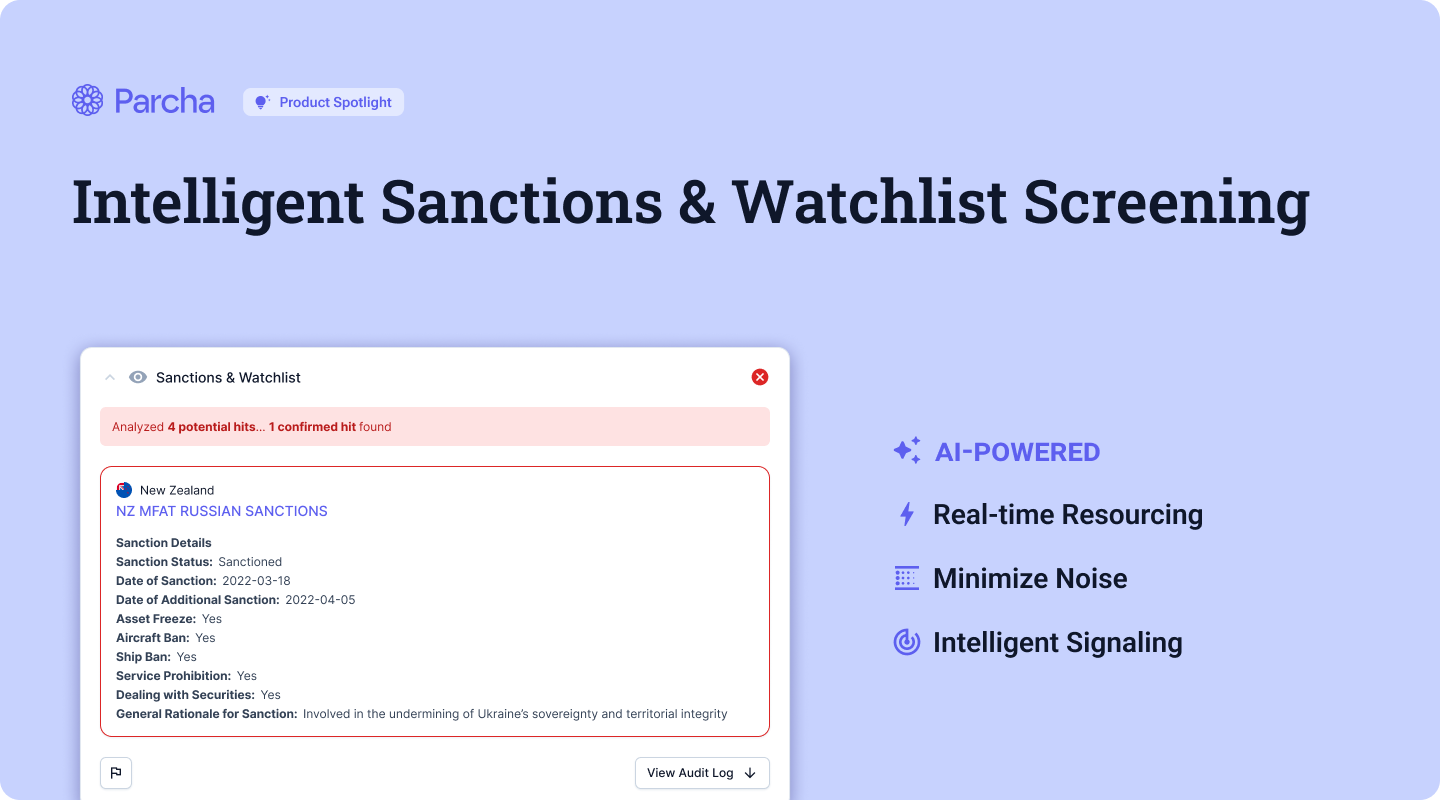

Intelligent Sanctions & Watchlist Screening

By considering multiple factors, Parcha significantly reduces false positives, allowing you to onboard legitimate businesses and individuals with confidence. Here's how it works:

- Real-time Resourcing: Parcha searches for matches against proprietary lists from the United Nations, European Union, OFAC, and other regulatory bodies covering 80 different countries that are updated every 30 minutes.

- Minimize Noise: Our advanced algorithms filter out potential false matches, accounting for common name variations by factoring cultural nuances, country of residence, nationality, and age ranges to zero in on the right entities from the start.

- Intelligent Signaling: Parcha’s AI only flags clients for manual review when a multitude of inputs indicate high signal confidence, saving you from manual review cycles that go nowhere.

Parcha's Sanctions & Watchlist Screenings

Key Benefits:

- As-it-happens Accuracy: Parcha’s proprietary sources update every 30 minutes so analysts are never checking against outdated lists.

- Resource Optimization: Focus analyst time where it belongs, on the most complex cases instead of parsing through false-positives.

- Faster Onboarding: Legitimate businesses and individuals can onboard sooner, capitalizing on customer intent.

Customization and Integration

We understand that every fintech has unique compliance needs. That's why we've made this feature highly customizable:

- Adjust sensitivity levels based on your risk appetite, allowing for more precise control over your onboarding.

- Pick and choose which watchlists to include in your screening process.

- Define custom risk thresholds for Parcha to score against and update them any time as requirements change.

Plus, our robust API allows for seamless integration into your existing onboarding flows.

Looking Ahead

AI-Powered Sanctions & Watchlist Screening is just one part of our comprehensive compliance solution. We're committed to continually enhancing our platform to address the evolving needs of the fintech industry. Stay tuned for more innovations that will help you onboard customers faster, more securely, and with less friction.

Ready to accelerate your compliance processes?

Reach out to our team at founders@parcha.ai to see how our AI-Powered Sanctions & Watchlist Screening can work for your business.

At Parcha, we're not just building features; we're crafting solutions that drive real business impact. We can't wait to see how you'll use this to accelerate your growth, enhance your compliance efforts, and delight your customers.