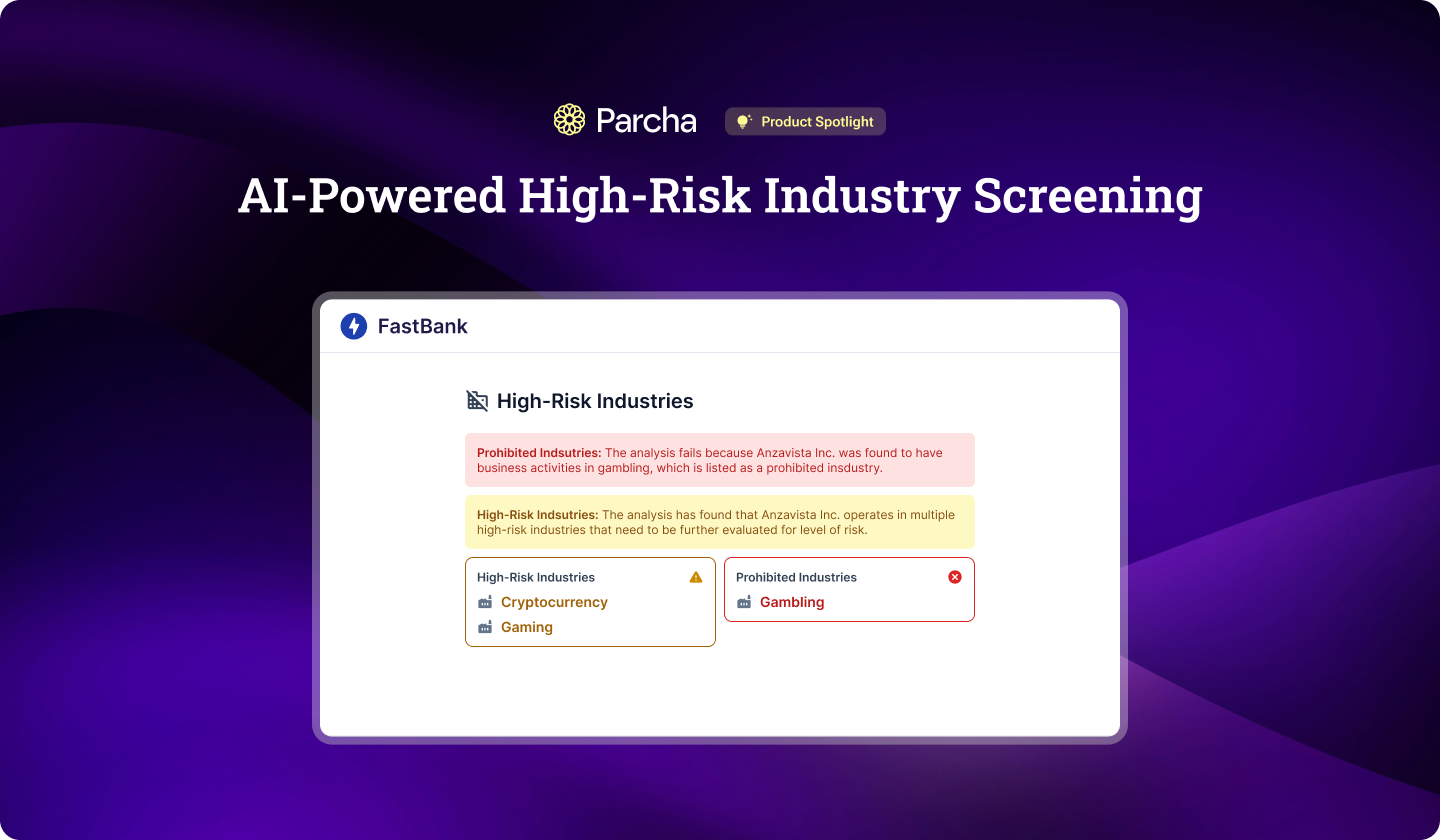

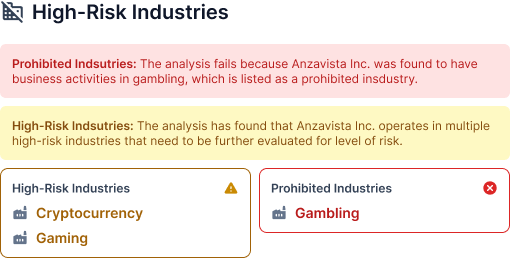

Product Spotlight: Reduce Exposure to High-Risk Industries

At Parcha, we're constantly innovating to help fintechs and banks streamline their operations while maintaining robust compliance. Today, we're excited to highlight one of our features: AI-Powered High-Risk Industry Screening.

The Problem

Balancing Growth with Risk Management

In the fast-paced world of fintech, onboarding new businesses quickly is crucial for growth. However, this speed must be balanced with thorough risk assessment to protect your platform and comply with regulatory requirements. Manually screening businesses for high-risk or prohibited industries is time-consuming, prone to errors, and can significantly slow down the onboarding process. Moreover, with increasing regulatory scrutiny on partner banks, it's more critical than ever for fintechs to make sure they identify and properly onboard high-risk businesses in industries like cannabis, money services, and cryptocurrency. The stakes for accurate industry classification and risk assessment have never been higher.

The Solution

AI-Powered High-Risk Industry Screening

Our new High-Risk Industry Screening feature leverages advanced AI to transform this critical process. Here's how it works:

- Comprehensive Analysis: Our AI examines the business's self-attested information and conducts a thorough analysis of its online presence.

- In-Depth Due Diligence: The system performs extensive online research to determine the business's products, services, operational countries, partners, and counterparties.

- Intelligent Comparison: Findings are compared against a customizable list of high-risk and prohibited industries specific to your regulatory requirements.

- Automated Decision-Making: Businesses operating in high-risk or prohibited countries are flagged or automatically denied, based on your risk tolerance settings.

Key Benefits

- Reduced Risk Exposure: Quickly identify and screen out businesses operating in high-risk or prohibited industries.

- Increased Efficiency: Eliminate hours of manual research and decision-making.

- Enhanced Compliance: Ensure consistent application of your risk policies and regulatory requirements.

- Faster Onboarding: Accelerate the approval process for low-risk businesses while maintaining thorough screening.

- Scalability: Handle high volumes of business screenings without increasing operational overhead.

Customization and Integration

We understand that risk tolerance and high-risk industries can vary based on your specific needs and regulatory environment. That's why our High-Risk Industry Screening feature is highly customizable:

- Tailor your list of high-risk and prohibited industries

- Set specific risk thresholds

- Customize recommendations for different risk levels

Our robust API allows for seamless integration into your existing onboarding flows, ensuring a smooth experience for both your team and your customers.

Looking Ahead

High-Risk Industry Screening is just one part of our comprehensive suite of risk management tools. We're committed to continually enhancing our platform to address the evolving needs of the fintech industry. Stay tuned for more innovative solutions that will help you grow your business confidently and securely.

Ready to accelerate your risk management process?

Reach out to our team at founders@parcha.ai to see how High-Risk Industry Screening can work for your business.

At Parcha, we're not just building features; we're crafting solutions that drive real business impact. We're excited to see how you'll use this tool to reduce risk exposure and accelerate your growth in a compliant manner.