Accelerate Business Onboarding with Real-Time Document Remediation

At Parcha, we're always searching for those 'ah-ha' solutions to the most significant challenges fintechs and banks face. Today, we're excited to introduce our latest breakthrough: Real-Time Document Remediation. This AI-driven feature is set to revolutionize how fintechs handle document verification during customer onboarding.

The Problem

A Friction-Filled Onboarding Experience

Talking to dozens of fintechs and banks over the last year, one of the frustrations that comes up time and time again with business onboarding is document verification. The constant back-and-forth with customers, the internal coordination nightmares between compliance, customer support, and sales, and the alarming drop-off rates in customer activations due to not being able to collect the proper documentation. These pain points aren't just inconveniences; they're roadblocks to growth and customer satisfaction.

The Solution

Real-Time Document Remediation

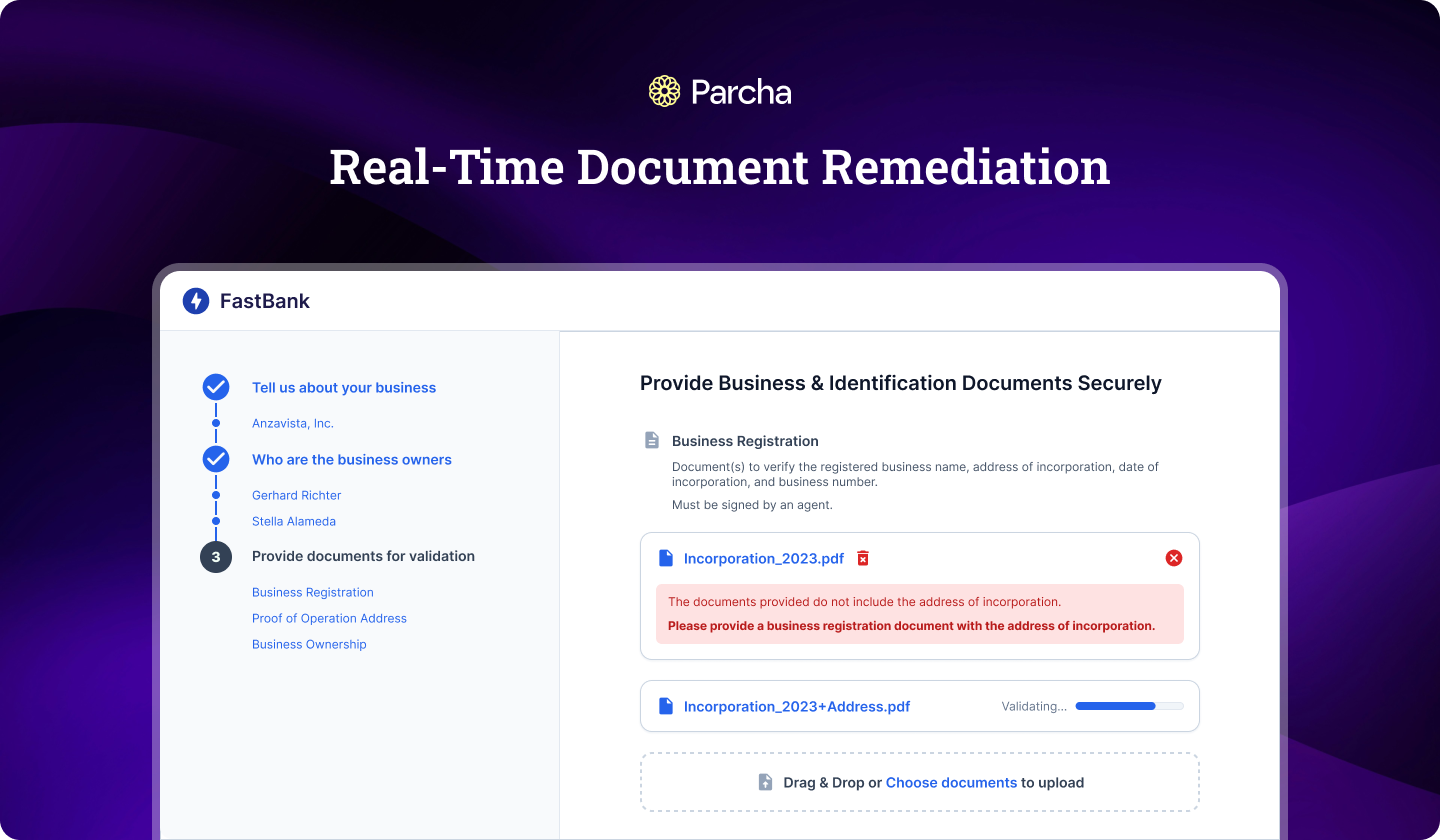

Our new Real-Time Document Remediation feature leverages cutting-edge AI to transform this process. Here's how it works:

- Intelligent Document Analysis: As soon as a customer uploads a document, our AI scans it for authenticity and relevance.

- Real-Time Feedback: If the document doesn't meet the required criteria, the customer receives immediate, specific guidance on what's needed.

- Automated Verification: Valid documents are instantly approved, eliminating manual review for straightforward cases.

- Comprehensive Audit Trail: Every step of the verification process is logged, ensuring full compliance and traceability.

See It In Action

Here's a demo of real-time document remediation in action:

In this demo, you'll see how our system handles both an incorrect document submission (a proof of address document outside of a valid time window) and a valid one (a business registration ). The speed and accuracy of the process is truly remarkable.

Key Benefits

- Reduced Drop-Off Rates: Real-time remediation keeps customers engaged in the onboarding process by providing immediate feedback.

- Increase Conversion: Customers who don't have to undergo a manual review are twice as likely to complete your onboarding flow.

- Improved Customer Experience: Clear, instant guidance helps customers get it right the first time.

- Operational Efficiency: Minimize the need for manual reviews and internal coordination.

- Compliance Confidence: Detailed audit logs and consistent application of verification criteria enhance compliance efforts.

Customization and Integration

We understand that every fintech has unique needs. That's why we've made this feature highly customizable:

- Tailor acceptable document types

- Set specific recency requirements

- Customize feedback messages

Plus, our robust API allows for seamless integration into your existing onboarding flows.

Looking Ahead

Real-Time Document Remediation is just the beginning. We're committed to continually enhancing our platform to address the evolving needs of the fintech industry. Stay tuned for more 'ah-ha' solutions that will help you onboard customers faster, more securely, and with less friction.

Ready to transform your onboarding process?

Reach out to our team at founders@parcha.ai to see how Real-Time Document Remediation can work for your business.

Remember, at Parcha, we're not just building features; we're crafting solutions that drive real business impact. We can't wait to see how you'll use this to accelerate your growth and delight your customers.