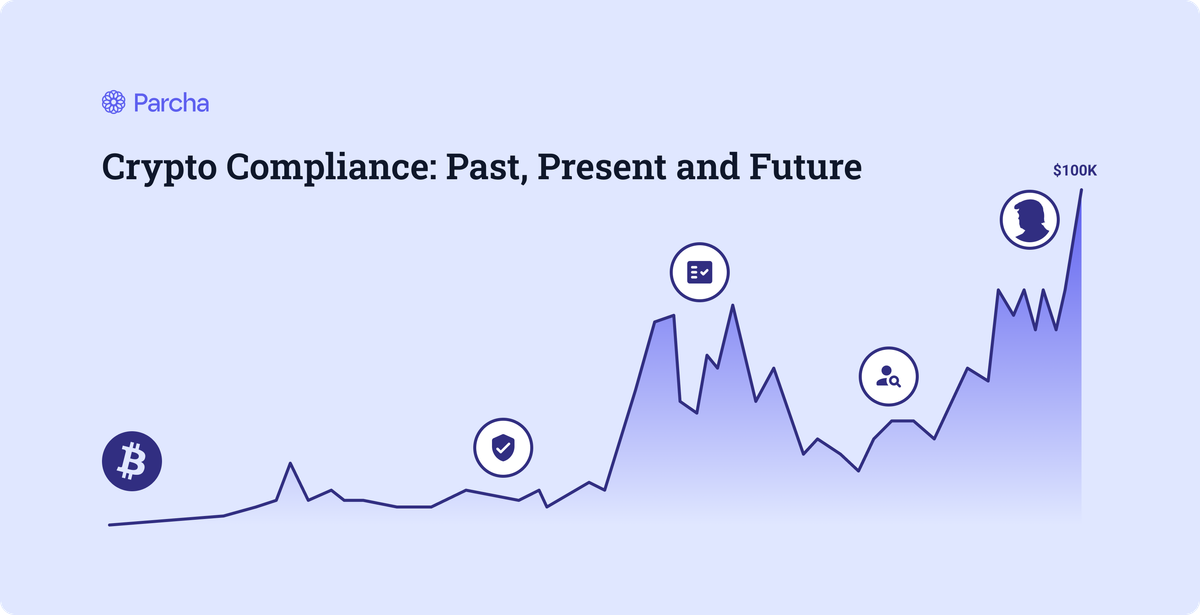

Crypto Compliance: Past, Present and Future

As Bitcoin approaches the historic $100,000 milestone, driven by post-election optimism and institutional interest, the cryptocurrency market finds itself at a critical juncture where the evolution of compliance, anti-money laundering measures, and risk management practices takes center stage.

In this blog post we explore the evolution of compliance in the cryptocurrency industry and share some practical tips on how to crypto companies can stay compliant.

Early Crypto Compliance Challenges

In the early days of cryptocurrency, compliance and risk management were largely uncharted territories, presenting unique challenges as the industry struggled to establish legitimacy and navigate regulatory uncertainties.

The decentralized nature of cryptocurrencies initially posed significant hurdles for traditional compliance frameworks. Bitcoin's pseudonymous transactions and the absence of centralized oversight made it difficult to implement standard Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This led to concerns about the potential misuse of cryptocurrencies for illicit activities, creating a stigma that the industry has worked hard to overcome.

One of the earliest and most notorious examples of compliance failures was the case of Silk Road, an online black market that operated from 2011 to 2013. The platform's use of Bitcoin for transactions highlighted the cryptocurrency's potential for facilitating illegal activities, prompting increased scrutiny from regulators and law enforcement agencies [1].

As the crypto ecosystem expanded, early exchanges often operated with minimal compliance measures, leading to security breaches and loss of user funds. The infamous Mt. Gox hack in 2014, which resulted in the loss of approximately 850,000 bitcoins, underscored the urgent need for robust security protocols and risk management strategies in the industry [2].

The lack of clear regulatory guidelines in many jurisdictions further complicated compliance efforts. Crypto businesses faced the challenge of operating in a legal grey area, with uncertainty about which existing financial regulations applied to their activities. This ambiguity led to inconsistent compliance practices across different platforms and jurisdictions, creating a fragmented regulatory landscape.

Early attempts at self-regulation emerged as the industry sought to address these challenges. In 2014, the Bitcoin Foundation established the Committee for Standardization of Bitcoin Compliance, aiming to develop best practices for AML compliance in the crypto space. However, these efforts were often hindered by the rapid pace of technological innovation and the diverse range of emerging crypto assets.

As Bitcoin's value began to surge, attracting more mainstream attention, the pressure to establish comprehensive compliance frameworks intensified. This period of early challenges laid the groundwork for the more sophisticated risk management and compliance strategies that have evolved as Bitcoin approaches the $100,000 milestone, reflecting the industry's journey from regulatory uncertainty to increasing legitimacy and institutional acceptance.

Regulatory Milestones in Cryptocurrency

As Bitcoin approaches the $100,000 mark, it's crucial to reflect on the key regulatory milestones that have shaped the cryptocurrency landscape. These developments have played a significant role in enhancing compliance, reducing risks, and fostering institutional adoption.

- 2013: FinCEN issues guidance classifying certain cryptocurrency activities as money services businesses, subject to Bank Secrecy Act regulations.

- 2014: New York introduces the BitLicense, one of the first comprehensive regulatory frameworks for cryptocurrency businesses.

- 2017: Japan recognizes Bitcoin as a legal payment method, leading to increased adoption and regulatory oversight.

- 2018: The European Union implements the 5th Anti-Money Laundering Directive (AMLD5), extending AML/CFT regulations to cryptocurrency exchanges and wallet providers.

- 2020: The U.S. Office of the Comptroller of the Currency (OCC) allows national banks to provide cryptocurrency custody services, marking a significant step towards mainstream financial integration.

- 2021: El Salvador adopts Bitcoin as legal tender, prompting discussions on cryptocurrency regulation at the national level.

- 2022: The European Union agrees on the Markets in Crypto-Assets (MiCA) regulation, establishing a comprehensive framework for crypto asset regulation.

- 2023: The U.S. Securities and Exchange Commission (SEC) approves the first spot Bitcoin ETFs, significantly enhancing institutional access to cryptocurrency investments.

- 2024: Post-election optimism drives Bitcoin's rally, with prices topping $98,000 and more than $4 billion streaming into U.S.-listed Bitcoin ETFs.

These milestones have collectively contributed to the maturation of the cryptocurrency market, paving the way for increased institutional involvement and the current surge towards the $100,000 mark. The regulatory landscape continues to evolve, with ongoing debates about the classification of various cryptocurrencies and the appropriate level of oversight needed to balance innovation with investor protection.

The Need for Regulatory Clarity

The rapidly evolving landscape of cryptocurrency regulation is marked by a complex web of rules and guidelines that vary significantly across jurisdictions, creating a pressing need for clarity. In the United States, the regulatory environment is particularly intricate, with different agencies such as the SEC, CFTC, and IRS each playing distinct roles. The SEC views many cryptocurrency offerings as securities, necessitating compliance with investor protection standards akin to those for publicly traded companies[1]. Meanwhile, the CFTC classifies cryptocurrencies like Bitcoin as commodities, focusing on deterring fraud and market manipulation[1].

This fragmented approach is mirrored globally. For instance, the European Union has introduced the Markets in Crypto-Assets Regulation (MiCA), which aims to create a unified framework across member states by setting licensing requirements and consumer protection standards[2]. However, individual countries within the EU still have varying tax treatments for cryptocurrencies[3]. The UK's Financial Conduct Authority (FCA) has also implemented specific KYC and AML requirements, yet crypto derivatives trading remains banned[4].

Adding to the complexity, some countries have adopted or are considering unique measures. Arizona, for example, is exploring legislation to allow state agencies to accept cryptocurrency for various payments[5]. Brazil has positioned its central bank as the supervisor for crypto assets to prevent scams and ensure market integrity[6].

As nations continue to craft their regulatory frameworks, there is an increasing demand from the industry for international cooperation and standardization. This call stems from the need for consistent compliance guidelines that can simplify cross-border operations and clarify legal obligations for investors. Industry stakeholders are particularly interested in having clear definitions of what constitutes a security versus a commodity in the crypto space, as well as standardized procedures for Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements[7][8].

Such clarity would not only mitigate risks associated with financial crimes but also create a more stable environment conducive to innovation within the cryptocurrency sector. By establishing uniform regulations, countries could better support technological advancements while safeguarding against illicit activities, thereby fostering trust and encouraging broader adoption of digital assets.

Future Outlook for Crypto Compliance

As Bitcoin edges closer to the $100,000 milestone, the cryptocurrency industry faces a critical juncture in balancing innovation with regulatory compliance. The incoming Trump administration is expected to bring significant changes to crypto regulation, potentially creating a more favorable environment while maintaining essential compliance standards.

The shift in regulatory landscape, along with the surge in institutional interest and the emergence of new financial products like Bitcoin ETFs, highlights the necessity for advancing risk management strategies. This evolution is essential to ensure that the industry can handle the complexities of these new developments effectively.

Moreover, as stablecoins gain traction for cross-border payments, they become a focal point for crypto's future, emphasizing the importance of compliance in this area. Stablecoins offer a promising solution for international transactions, but they also bring about new regulatory challenges that must be addressed to facilitate their growth and integration into the financial system.

The challenge for the industry lies in maintaining robust security and compliance measures while fostering continued growth and adoption. As the total crypto market value surpasses $3 trillion for the first time, the focus will likely shift towards developing more sophisticated compliance tools, enhancing market surveillance, and adapting to potential regulatory changes.

Navigating these challenges will be pivotal for solidifying cryptocurrencies as mainstream financial assets. The Trump administration's pro-crypto stance could potentially ease some regulatory burdens, encouraging innovation while still ensuring necessary compliance. This balance will be key to achieving long-term sustainability amid increasing scrutiny and adoption.

Crypto Compliance Strategies

As the cryptocurrency industry continues to mature, companies must evolve their financial crime compliance systems to meet increasingly complex regulatory requirements and combat sophisticated criminal activities. Here are key strategies for crypto companies to improve their compliance frameworks:

- Implement advanced blockchain analytics: Utilize cutting-edge tools that leverage artificial intelligence and machine learning to detect suspicious patterns across multiple blockchains and identify high-risk transactions in real-time.

- Enhance KYC/AML procedures: Adopt more rigorous customer due diligence processes, including ongoing monitoring and risk-based approaches to verify user identities and assess potential threats.

- Develop comprehensive transaction monitoring: Implement systems capable of screening transactions against sanctions lists, detecting structuring attempts, and identifying other red flags indicative of money laundering or terrorist financing.

- Integrate cross-chain analysis: As crypto ecosystems become more interconnected, companies should invest in solutions that can trace fund flows across different blockchains and asset types to maintain a holistic view of user activities.

- Automate regulatory reporting: Streamline the process of filing Suspicious Activity Reports (SARs) and other mandatory disclosures through automated systems to ensure timely compliance with reporting obligations.

- Conduct regular security audits: Perform frequent assessments of cybersecurity measures, including penetration testing and vulnerability scans, to protect against evolving threats and data breaches.

- Implement robust risk scoring: Develop dynamic risk rating systems that consider on-chain and off-chain data to create comprehensive user risk profiles and inform decision-making.

- Adopt a risk-based approach: Tailor compliance efforts based on the specific risks associated with different products, services, and customer segments to allocate resources effectively.

- Invest in staff training: Provide ongoing education for compliance teams to keep them updated on the latest regulatory requirements, emerging threats, and best practices in crypto compliance.

- Collaborate with regulators: Engage proactively with regulatory bodies to stay informed about upcoming changes and contribute to the development of practical compliance frameworks for the crypto industry.

- Implement travel rule solutions: Develop or integrate systems that comply with FATF's travel rule requirements for transmitting originator and beneficiary information in crypto transactions.

- Leverage decentralized identity solutions: Explore the use of blockchain-based identity verification systems to enhance privacy while meeting regulatory requirements for user identification.

By implementing these strategies, crypto companies can strengthen their financial crime compliance systems, mitigate risks, and foster trust among users and regulators as the industry continues to evolve and expand.

Want to discuss your crypto compliance strategy with an expert? We're here to help at Parcha. Speak to our CEO & Co-Founder AJ Asver, who built risk and compliance systems at Coinbase by booking time below: