Tech Deep Dive: A Smarter Approach to Document Verification

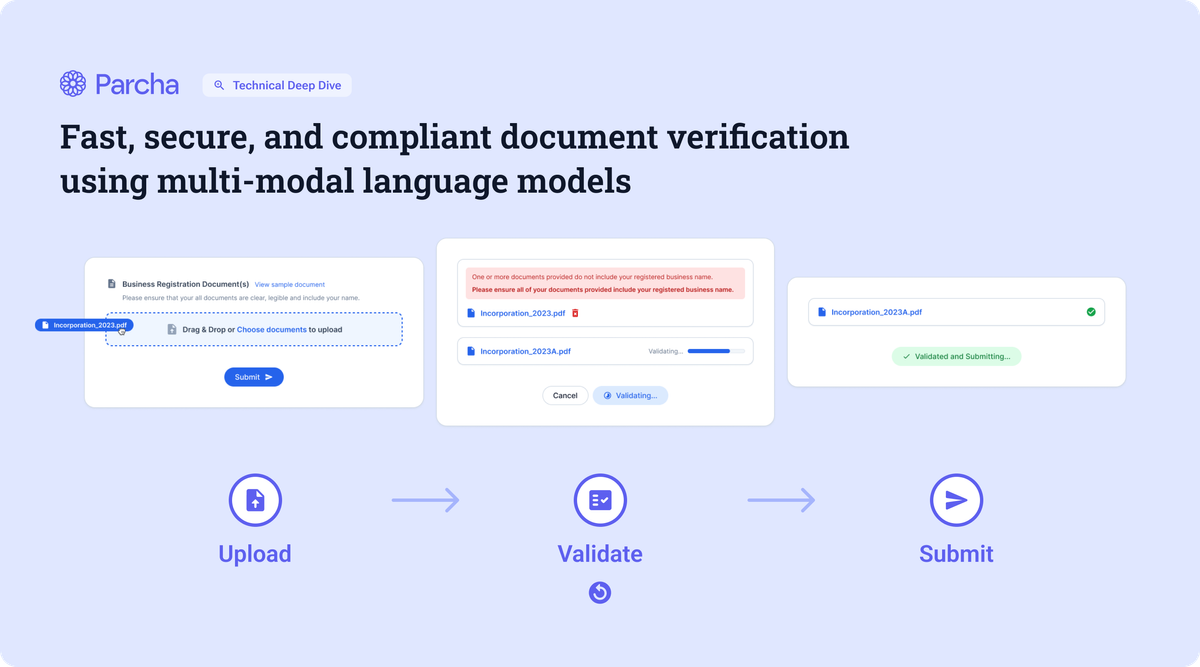

Fast, secure, and compliant document verification using multi-modal language models

At Parcha, our journey into document verification emerged from years in the trenches. In our previous roles at Brex, we worked alongside compliance teams, watching them wrestle with automation attempts that promised efficiency but delivered frustration. We saw firsthand how traditional solutions - OCR systems, rules engines, and pre-trained processors - weren't just showing their age. They were fundamentally misaligned with the real-world complexity of modern fintech operations.

The reality of traditional document verification forces companies into an impossible choice: either dial up the sensitivity of automated checks and drown your compliance team in false positives or dial it down and risk letting fraudulent documents slip through. We've seen compliance teams build massive manual review operations to handle the flood of flagged documents, most of which are perfectly valid. Meanwhile, sophisticated fraud attempts continue to exploit the blind spots in these rigid, rules-based systems. The conventional approach to document verification isn't just outdated—it's fundamentally broken, unable to balance security with efficiency in a way that scales.

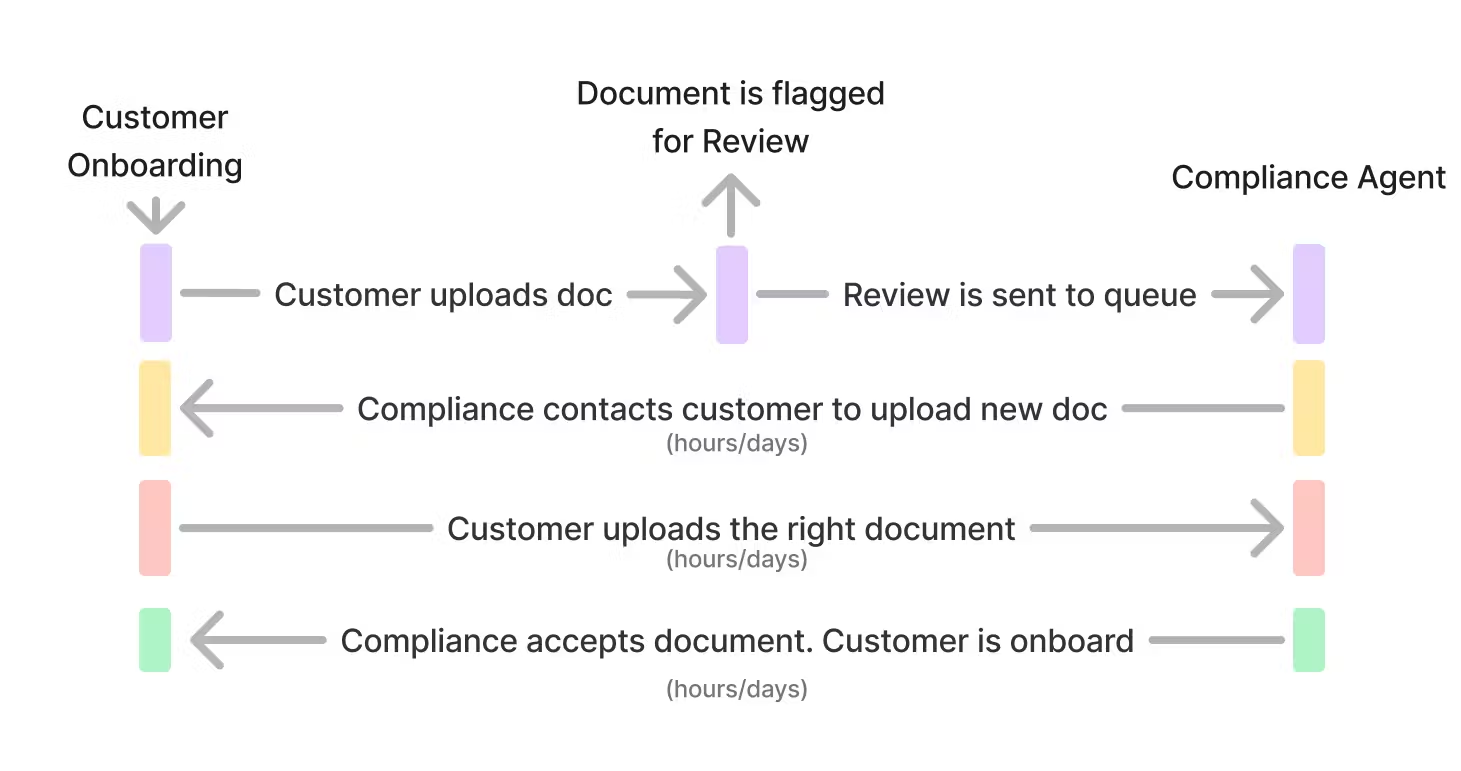

Understanding Traditional Document Verification

The complexity of document verification becomes apparent when you look at a typical workflow. A customer submits their document, beginning what should be a straightforward process. But in reality, this starts a lengthy cycle that can stretch from hours to days, frustrating customers and straining compliance teams. Every document follows a winding path through various checkpoints. Trying to be thorough, compliance teams cast a wide net with their automated systems. The result? A flood of flagged documents overwhelmed manual review queues. Even simple mismatches – like a customer accidentally uploading a tax letter instead of an incorporation document – trigger an entire review cycle that can take days to resolve.

The challenges compound when considering the sheer variety of documents these systems must handle. Each jurisdiction has its incorporation document format, which has constantly evolved. Proof-of-address documents arrive in countless variations, from utility bills to bank statements. International documents add another layer of complexity with their diverse layouts and languages.

Building a document verification model is a neverending endeavor. Each new document type requires a meticulously labeled and validated compilation of reference examples across jurisdictions. Teams spend months building training pipelines, annotating documents, and evaluating model performance. Every time a government changes its incorporation document or a new international format emerges, the entire process starts over. Traditional approaches demand complete retraining for each variation, consuming immense resources and creating brittle, context-specific models that quickly become obsolete.

This is where the real bottleneck emerges. Compliance teams face an ever-growing backlog of manual reviews, forcing them to expand their operations to maintain pace. More reviewers mean higher costs and increased security risks as sensitive documents pass through more hands. Meanwhile, customers watch their onboarding process stretch from hours into days or weeks, creating friction at the very start of their relationship.

Rethinking Document Verification from First Principles

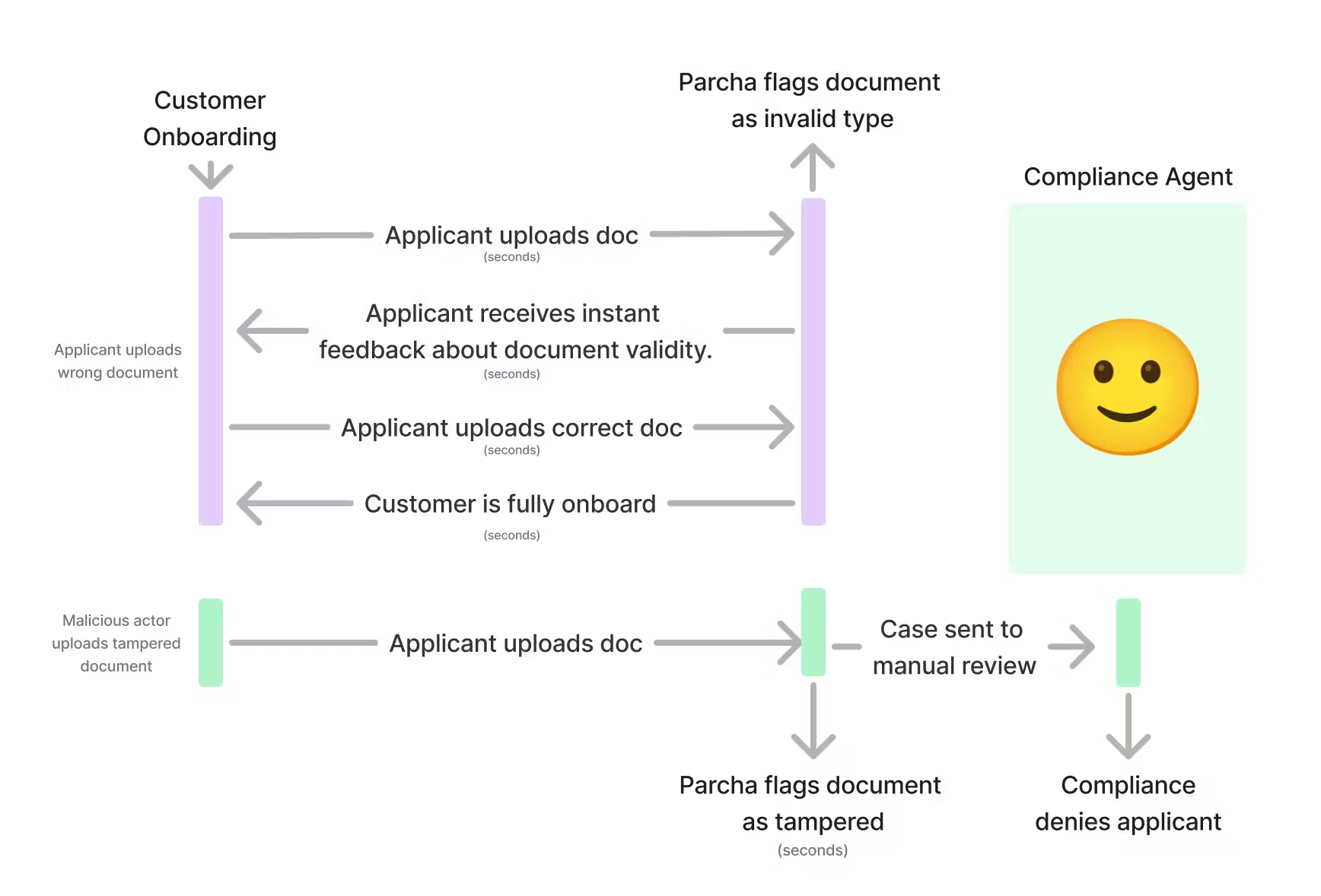

When we started building Parcha, we didn't just want to add another layer of automation to an already broken process. We needed to rethink how document verification should work fundamentally. Our experience taught us that even the most skilled compliance analysts don't work in sequential steps like traditional automated systems do. Instead, they simultaneously process multiple streams of information – the document's visual layout, textual content, subtle inconsistencies, and contextual clues. This insight led us to develop a radically different approach. Rather than forcing documents through a rigid sequence of checks, we built a system that mirrors how expert analysts work. The results transform the verification process: what used to take days now happens in seconds without compromising security.

Real-Time Intelligence at Work

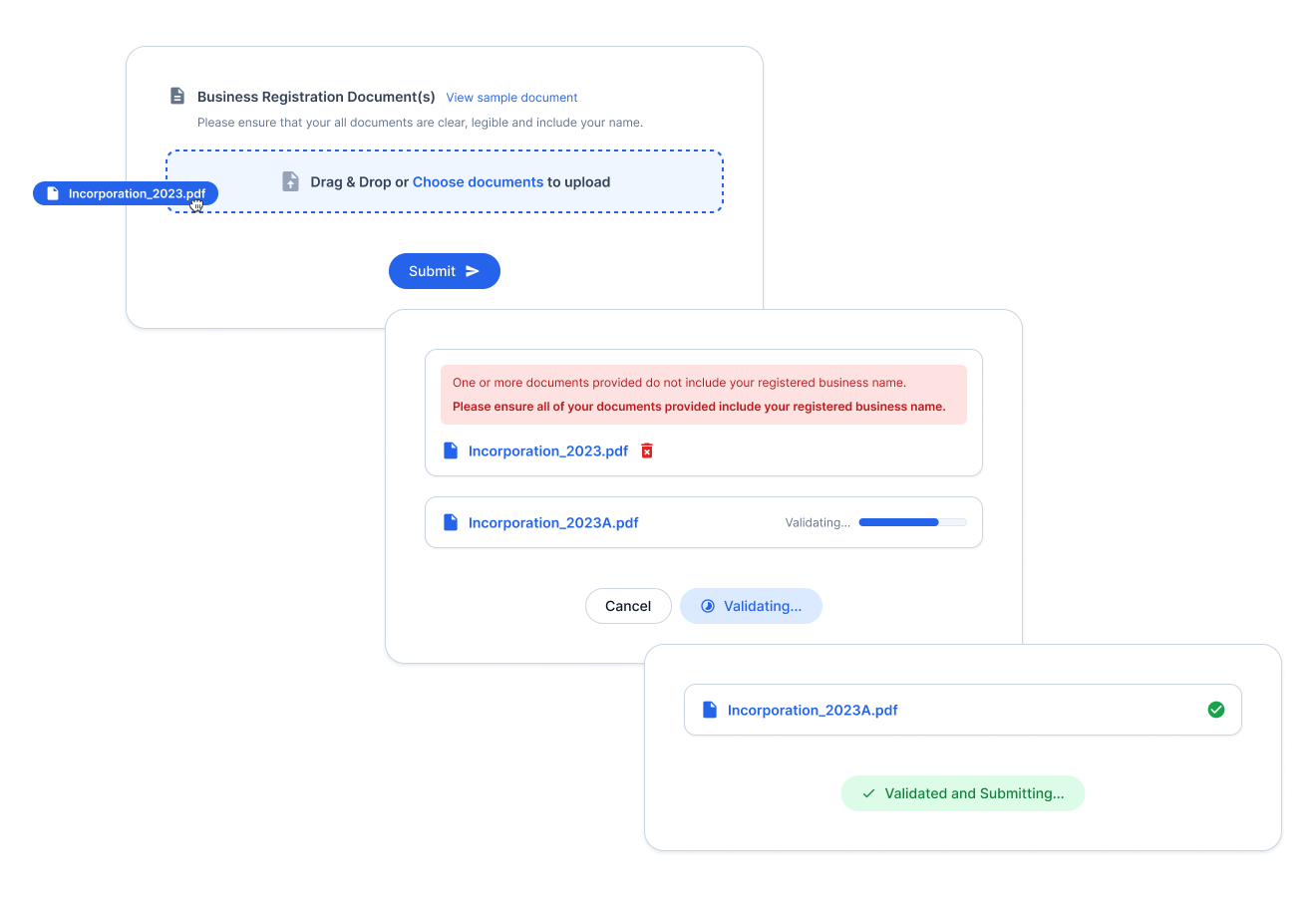

The most visible impact is in how we handle document submissions. Traditional systems queue a document for review, leaving customers waiting for feedback. Our system provides instant, intelligent responses. Upload a tax letter instead of an incorporation document. You'll know immediately, with clear guidance on what's needed instead. Submit a valid document. The verification starts instantly, utilizing multiple parallel analysis streams. But speed isn't everything – especially when dealing with sophisticated fraud attempts.

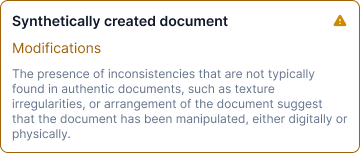

This is where our multi-layered approach truly shines. While valid documents sail through verification in seconds, suspicious submissions automatically trigger additional scrutiny layers. Our system examines everything from metadata to pixel-level patterns, flagging potential issues faster and more reliably than traditional manual reviews.

Vision-Based Layout Analysis: Beyond Text Recognition

We've reimagined how documents should be analyzed, moving beyond traditional computer vision to leverage the latest advances in large language models with visual capabilities. This wasn't just a technical upgrade—it represented a complete shift in how we approach document understanding:

- Vision Language Models as Document Experts: Instead of building rigid rules or training specialized models for each document type, we leverage vision language models that can understand documents contextually, much like a human expert would. These models don't just see pixels—they understand the semantic relationships between visual elements, text, and layout patterns. When analyzing a Delaware incorporation document, for instance, they can identify where the seal should be, understand its relationship to surrounding elements, and detect subtle irregularities that traditional computer vision might miss.

- Reference-Based Learning: Our approach pairs vision language models with a dynamic library of reference documents across jurisdictions and document types. This combination is powerful—the models can transfer their understanding from one document type to another while our reference library provides ground truth for verification. When a new document format appears, the system doesn't need complete retraining; it adapts its existing knowledge to understand the new format.

- Adaptive Document Intelligence: Through continuous exposure to verified documents and explicit feedback from our compliance partners, our vision language models build an ever-evolving understanding of document patterns. This goes beyond simple template matching—our models learn to recognize the implicit rules and patterns that make a document legitimate, from the proper relationship between dates and signatures to the expected quality and consistency of official seals.

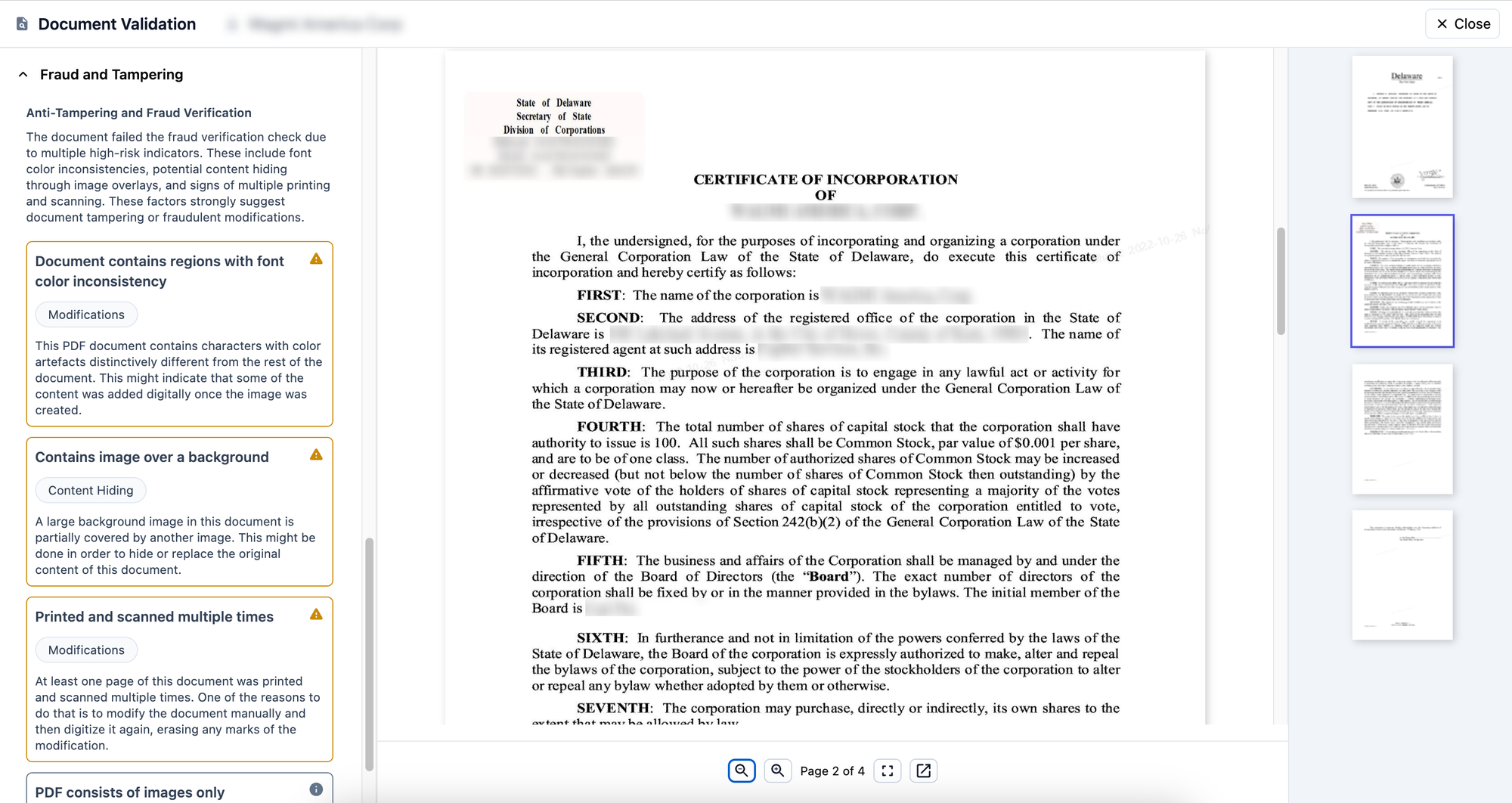

Digital Forensics Through Metadata

Working alongside our partner Resistant AI, we've built a sophisticated metadata validation system beyond simple file analysis. What makes our approach unique is how we turn complex metadata signals into actionable insights:

- Resistant AI Integration: Our partnership with Resistant AI provides deep metadata analysis that can detect sophisticated tampering attempts. Their system examines everything from creation timestamps to digital signatures, uncovering the subtle traces that fraudsters leave behind.

- Language Model Analysis: We feed Resistant AI's findings into our vision language models, which contextualize these technical signals. The models don't just flag issues—they understand what different metadata patterns mean for specific document types and can explain their reasoning in clear, actionable terms.

- Customer-Driven Intelligence: Every business has different risk tolerances and compliance requirements. Our system allows customers to configure precisely what kinds of metadata discrepancies matter to them, and our models adapt their analysis accordingly, providing relevant alerts that match each customer's specific needs.

Microscopic Visual Analysis: Building Intelligence at Scale

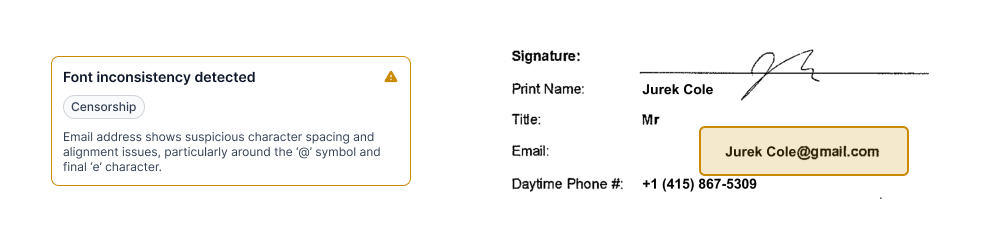

For those subtle details that human experts catch—like inconsistent font kerning or unusual pixelation—we've built an intelligent analysis system powered by vision language models. What sets our approach apart is how we orchestrate multiple analysis streams simultaneously:

- Parallel Visual Processing: Our workflow automation layer breaks documents into regions and analyzes them concurrently. Multiple vision language models examine different aspects of the document simultaneously—from font consistency to color patterns—dramatically reducing processing time without sacrificing accuracy.

- Contextual Understanding: Rather than flagging anomalies, our vision language models understand the relationships between document elements. They can tell when a signature looks out of place because of its pixels and context within the broader document layout.

- Intelligent Workflow Automation: Our system doesn't just run checks—it orchestrates them intelligently. Based on initial findings, additional specialized analyses can be triggered automatically. For example, if a model detects subtle font inconsistencies, it might initiate a deeper forensic analysis of that specific region while continuing other verification steps.

Real-world Use Challenges

Document verification in fintech isn't about theoretical edge cases—it's about handling actual documents from businesses trying to access financial services. Here's how our multi-layered approach helps companies like Airwallex, Bancoli, and FV Bank use our document verification platform today:

Instant Onboarding: avoiding the back-and-forth

Financial institutions process hundreds of business registrations daily. Without intelligent verification, even simple document mismatches can cause hours or days of delay. We've transformed this process through real-time analysis. When customers upload documents, our vision language models immediately assess whether they match the required document type. This means no more waiting in review queues for simple verification—businesses get instant feedback and clear guidance when providing different documentation.

Identifying fraudulent documents

The most interesting fraud attempts often reveal themselves in unexpected ways. Take the case of incorporation documents edited in PDF editing software—a pattern several of our customers identified as a common thread in fraud attempts. By combining Resistant AI's metadata analysis with customer-driven configurations, we automatically flag documents that show these suspicious characteristics. What makes this powerful isn't just the detection—it's how our system learns from patterns across our customer base while maintaining each institution's risk preferences and data privacy.

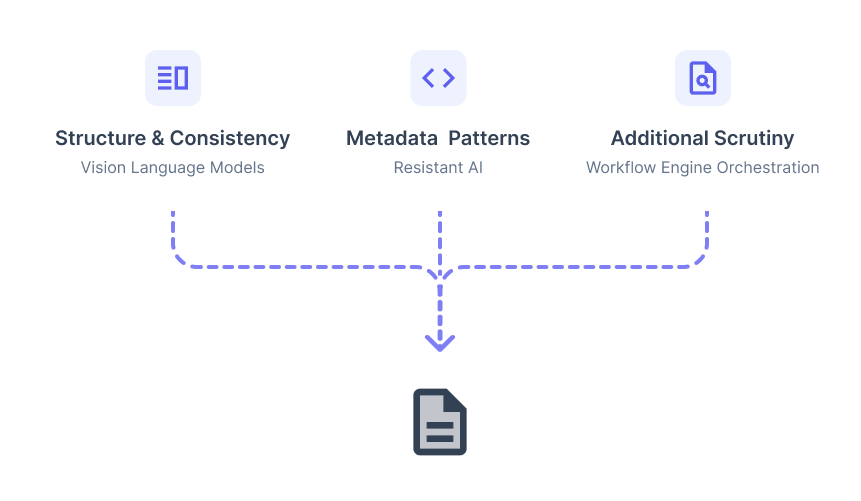

Multi-Layer Defense

Modern document fraud is sophisticated, often passing surface-level checks. Our approach runs multiple analysis streams in parallel: vision language models examine document structure and consistency, Resistant AI analyzes metadata patterns, and our workflow engine orchestrates additional scrutiny when needed. These layers work together, each contributing a different perspective on document authenticity. What makes this approach effective isn't any single check—it's how these components work together. When our vision models detect subtle inconsistencies in formatting or Resistant AI flags unusual metadata patterns, our workflow engine automatically triggers deeper analysis. This multilayered scrutiny happens in seconds, not the hours or days traditional review processes require.

What's Next for Document Verification

Document verification in fintech isn't about incremental improvements anymore. Our work with financial institutions has shown that the real opportunity lies in fundamentally rethinking how we approach this critical process. By combining vision language models, intelligent workflows, and deep metadata analysis, we're not just solving today's challenges—we're building a foundation that evolves with emerging threats. The impact we're seeing goes beyond metrics, though they tell part of the story:

- Manual review queues have shrunk dramatically as real-time verification catches issues early.

- False positives have plummeted while fraud detection has improved, thanks to our multi-layered approach.

- Customer onboarding times have been cut from days to minutes for legitimate documents.

- Compliance teams have complete visibility into every verification decision.

But perhaps what excites us most is how this transforms the role of document verification in financial services. What was once seen as a necessary bottleneck has become a competitive advantage. For our customers, this means the ability to scale operations confidently, knowing they have a verification system that strengthens security while improving customer experience. When document verification works as it should, it disappears into the background. Legitimate customers get fast access to financial services, fraud attempts get caught early, and compliance teams get the necessary controls. Speed, security, and compliance don't have to be competing priorities—they're the natural outcomes of building more intelligent document verification workflows.